Investing in mutual funds is one of the most popular and convenient ways for Indian investors to build wealth over time. Understanding NAV and what are mutual funds is essential to make informed investment decisions. NAV, or Net Asset Value, is a vital concept for anyone investing in or considering mutual funds. This article delves into why NAV matters in mutual fund investments, explains NAV in detail, and clarifies the fundamentals of mutual funds to help you maximise your returns confidently.

What are mutual funds – a brief overview

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. Professional fund managers manage these funds, making investment decisions on behalf of investors. There are numerous types of mutual funds, ranging from equity funds, debt funds, hybrid funds to liquid funds, each serving different investment goals and risk appetites.

The key benefit of mutual funds is diversification, which spreads out risk compared to investing in individual stocks or bonds. Mutual funds also offer liquidity, professional management, and ease of investing even with relatively small amounts such as Rs. 5,000 onwards in many schemes.

Understanding NAV – the core concept

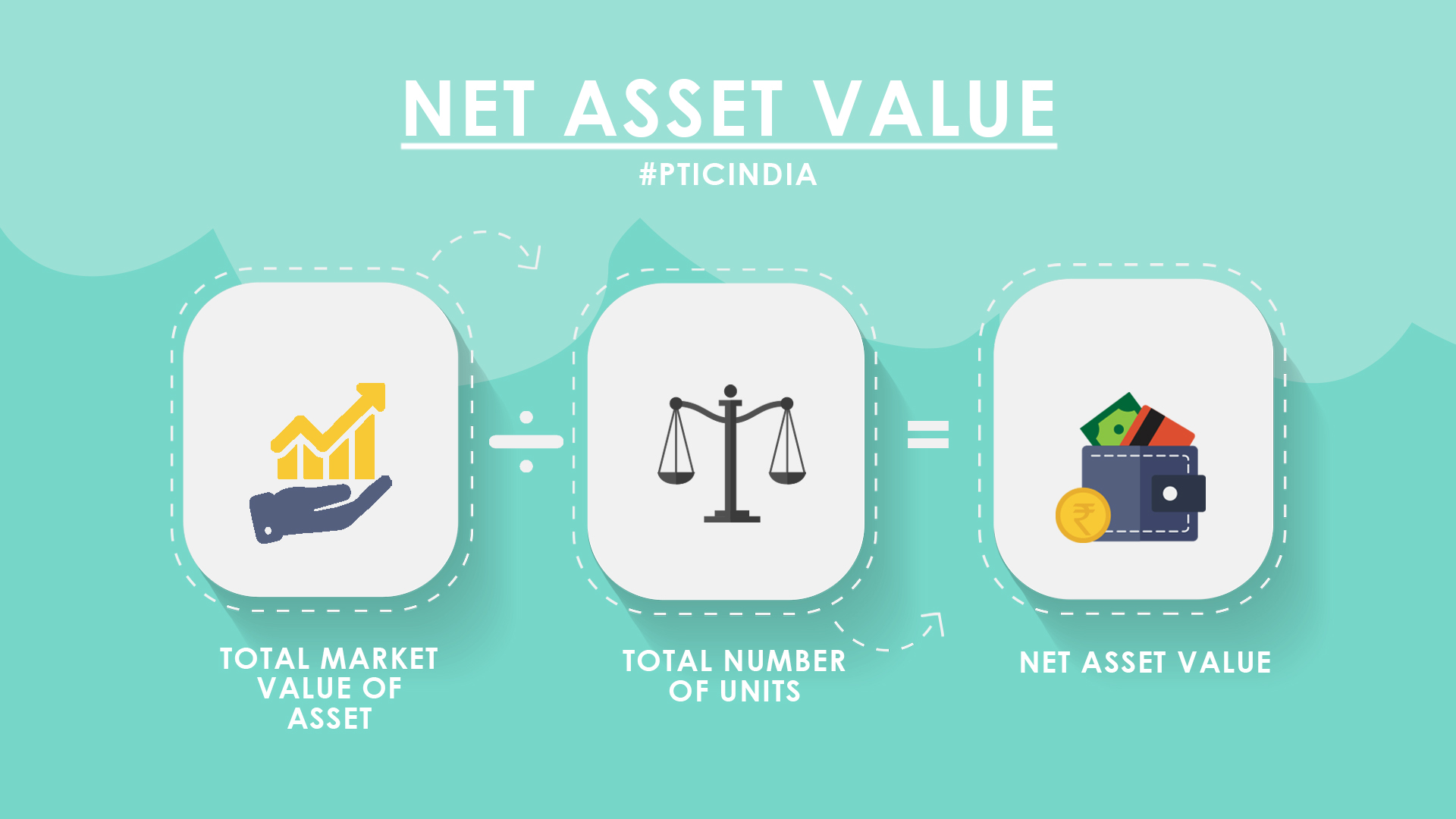

NAV or Net Asset Value represents the per-unit market value of a mutual fund on any given day. Essentially, it is the price at which investors can buy or sell units of a mutual fund scheme. NAV is calculated by dividing the total market value of the fund’s assets minus its liabilities by the total number of units outstanding.

NAV (Rs.) = (Market value of assets – Liabilities) / Number of units outstanding

Since the assets held by mutual funds fluctuate daily based on market conditions, NAV changes every business day. Unlike stocks with live prices fluctuating constantly during trading hours, mutual fund NAVs are calculated once a day after the market closes.

NAV as the price indicator

NAV is the price at which mutual fund units are bought and sold. When you invest in a mutual fund, you are purchasing units based on the NAV declared at that time. Similarly, when redeeming units, the amount you receive depends on the current NAV. This makes NAV the key reference point for all investor transactions in mutual funds.

NAV and reflective of fund performance

While NAV itself does not directly indicate returns, changes in NAV over time show the appreciation or depreciation of the investment. For instance, if the NAV of an equity fund rises from Rs. 100 to Rs. 120 in a year, it represents a 20% gain (excluding dividends and distributions). Investors commonly track NAV trends to assess fund performance.

NAV variations across fund types

Different types of mutual funds have different NAV behaviours. Debt funds and liquid funds tend to have relatively stable NAVs with minimal fluctuations. Equity funds, due to market volatility, experience more significant NAV changes. Understanding NAV variations helps investors choose funds aligned with their risk tolerance.

NAV and expense ratios

The NAV reflects deductions such as fund management fees and other operational expenses presented as an expense ratio. These costs reduce the gross asset value, impacting the NAV. Therefore, funds with lower expense ratios generally preserve NAV better over the long term.

NAV does not equal market price of the underlying securities

It is crucial to understand that the NAV does not directly represent the prices of individual securities held by the fund but their aggregate value after expenses and liabilities. NAV aggregates all assets and liabilities and spreads the value over total units.

This also means a high NAV does not necessarily mean a better investment. Some investors confuse a higher NAV with higher returns, which is incorrect. What matters more is the growth rate and stability of NAV over time rather than its absolute value.

How NAV affects mutual fund investment decisions

When investors consider investing in mutual funds, NAV influences decisions in several ways:

– choosing entry points: Investors may look at NAV trends to decide when to enter or exit a fund, aiming to invest during lower NAV periods.

– comparing funds: NAV growth rates over time help compare performance across similar schemes.

– understanding returns: NAV appreciation plus dividends represent total returns.

– calculating investment value: The value of any investor’s holding is simply the current NAV multiplied by the number of units held.

Importance of daily NAV updates in the indian market

SEBI mandates that all mutual funds in India publish NAVs daily to provide transparency and allow investors to track their holdings accurately. You can find NAV updated daily on fund house websites, financial news portals, and the mutual fund section of NSE and BSE websites.

Consistent daily NAV disclosure fosters trust and enables investors to make timely and informed decisions based on the most recent valuation of their investments.

Factors influencing NAV fluctuations

Multiple factors cause NAV to fluctuate regularly:

– market movements: Stock and bond price changes directly affect fund asset values.

– fund purchases and redemptions: When investors invest or redeem, the fund manager may need to buy or sell portfolio assets, impacting cash flows.

– income and distributions: Interest, dividends, and capital gains received by the fund increase asset value before distributions.

– fund expenses: Management and operational costs reduce NAV.

Understanding these factors can help investors avoid reacting impulsively to normal NAV fluctuations caused by market volatility.

the role of dividends and distributions on NAV

Dividend declarations by the mutual fund reduce the NAV by the dividend amount on the ex-dividend date. However, for dividend reinvestment plans (DRIPs), dividends are used to purchase additional units, increasing unit holdings while NAV adjusts accordingly.

Capital gains distributions also impact NAV but add to investors’ total returns. Hence, NAV movement alone does not fully capture an investor’s realised income from the fund.

How to use NAV in comparing mutual funds

When choosing mutual funds, comparing the NAV growth trajectory over multiple years gives insight into fund performance. Consider the following while comparing:

– Look at total returns incorporating NAV growth plus dividends.

– Analyse consistency in NAV appreciation.

– Compare NAV against benchmark indices and peers.

– Factor in the expense ratio impact on NAV.

This holistic analysis ensures better fund selection aligned with investment goals.

Misconceptions about NAV in mutual funds

Several common myths exist about NAV:

– higher NAV means better fund: NAV values depend on units issued since inception; a lower NAV fund may have delivered superior returns.

– NAV is the only performance metric: While important, investors must consider other factors like portfolio quality, fund manager expertise, and expense ratio.

– NAV static value for debt funds: Although debt fund NAVs are more stable, they still fluctuate based on interest rate and credit risk changes.

Dispelling such misconceptions is vital to a rational approach towards investing in mutual funds.

Conclusion

In conclusion, understanding NAV and what are mutual funds is indispensable for Indian investors aiming to build a robust investment portfolio. NAV serves as the daily price at which mutual fund units are transacted and reflects the underlying portfolio’s value adjusted for expenses and liabilities. Awareness of NAV’s role enables investors to evaluate fund performance realistically, make informed investment decisions, and avoid common pitfalls.

Mutual funds continue to gain popularity in India because of their ease, diversification, and professional management. By closely monitoring NAV movements and going beyond just NAV values to evaluate total returns and fund fundamentals, investors can harness the full potential of mutual funds in wealth creation.

Invest wisely and focus on long-term growth by understanding the true significance of NAV in your mutual fund investments.