In today’s digital-first economy, accepting online payments isn’t optional—it’s a necessity. Whether you’re running a startup e-commerce site or a large enterprise, online credit card payment processing is central to how you get paid. But while credit card transactions may appear seamless on the surface, many business owners are caught off guard by unexpected charges that quietly eat away at their profit margins.

So what’s behind the curtain? What fees are you really paying beyond the standard transaction rate? At Renaissance Advisory, we’ve worked with hundreds of business owners who only discovered these hidden costs after they were locked into contracts. In this article, we’ll break down the most common (and often overlooked) fees you’ll find when working with a credit card processing provider—and how you can avoid being overcharged.

The Basics: What You Think You’re Paying

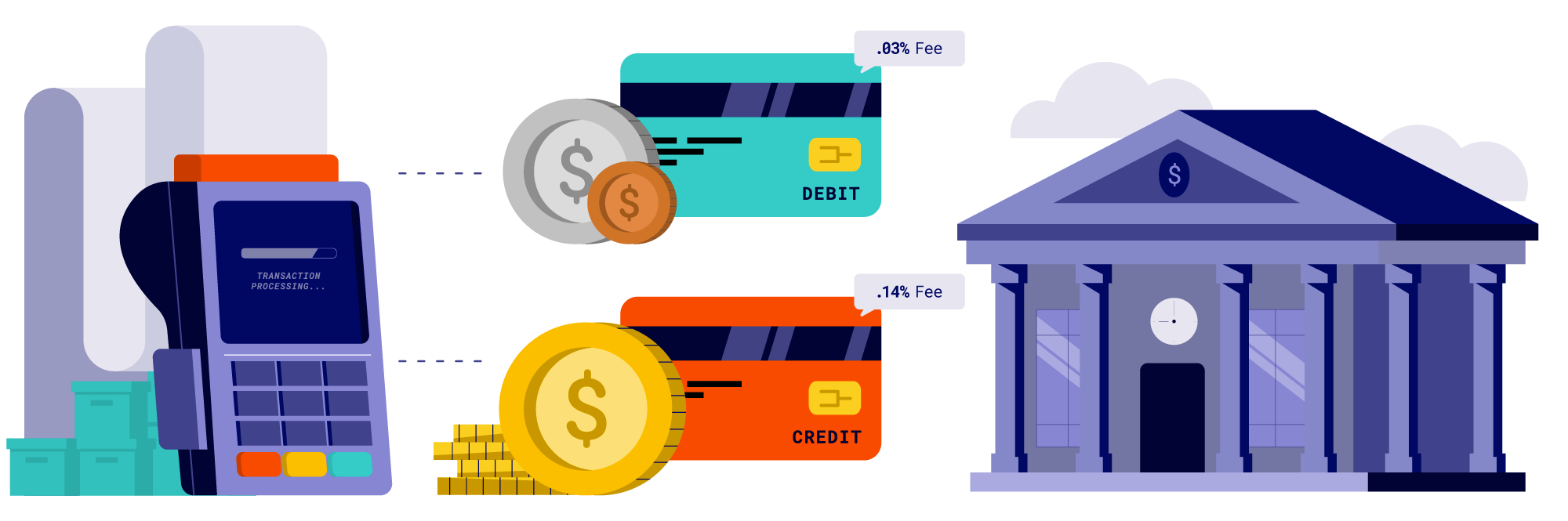

Most businesses sign up with a payment processor under the assumption that they’re only paying a simple transaction fee—usually a percentage of the sale plus a small flat fee (e.g., 2.9% + $0.30). While this rate is widely advertised, it’s often just the beginning.

Processors often use tiered pricing, interchange-plus pricing, or flat-rate pricing models. But even within these, there are layers of extra charges that many business owners are unaware of.

1. Statement Fees

A commonly overlooked fee is the monthly statement fee, which some providers charge simply for generating a report of your transactions. While this may be a minor amount (say $5 to $10 a month), over time, it adds up—especially if you’re not even using the statements they provide.

How to avoid it:

Ask your provider if this fee is negotiable or if you can opt for digital-only statements to reduce or waive the charge.

2. PCI Compliance Fees

PCI compliance is mandatory for any business accepting credit card payments online. Many credit card processing providers charge a monthly or annual PCI compliance fee, which supposedly helps you meet the required security standards.

However, not all processors actually help you become compliant. You might end up paying the fee without receiving meaningful support or services.

How to avoid it:

Choose a provider that includes PCI support in their service or consult with a third-party like Renaissance Advisory to ensure you’re compliant without paying unnecessary fees.

3. Non-Compliance Fees

Ironically, if you fail to meet PCI standards, you may be charged a non-compliance fee, which can be as high as $30–$50 per month. These charges kick in when you don’t complete your self-assessment questionnaire (SAQ) or maintain required security measures.

How to avoid it:

Always stay current with your PCI compliance requirements. Most importantly, make sure your processor reminds you about deadlines and provides clear guidance.

4. Gateway Fees

When you accept payments through a website or online store, you often need a payment gateway to securely transfer data between your customer’s bank and your merchant account.

Some online credit card payment processing providers include the gateway in their standard fee. Others charge a separate gateway fee—either monthly (e.g., $10–$25) or per transaction (e.g., $0.05–$0.10).

How to avoid it:

Opt for an all-in-one solution that includes gateway services or negotiate with your provider to waive this fee if you process large volumes.

5. Batch Fees

Every time you “settle” or “batch out” your daily transactions, some processors charge a batch fee, usually $0.10–$0.30 per batch. This may not seem like much, but daily batching can mean up to $10 per month in fees.

How to avoid it:

Confirm whether your provider charges per batch or per transaction. Consider batching less frequently (if allowed) to minimize charges.

6. Chargeback Fees

A chargeback happens when a customer disputes a charge and asks the credit card company to reverse it. Most providers charge a fee—often $15–$35 per incident—regardless of whether the dispute is resolved in your favor.

These fees can be especially painful for small businesses, and multiple chargebacks may also affect your processing rates or cause account suspension.

How to avoid it:

Maintain detailed transaction records, offer excellent customer service, and clearly display return/refund policies. At Renaissance Advisory, we help clients build systems that reduce chargebacks and respond effectively when they happen.

7. Early Termination Fees (ETFs)

Many processors lock you into long-term contracts and include a clause that penalizes you for canceling early. These early termination fees can range from $250 to over $500, or even the full remainder of the contract.

How to avoid it:

Always read the contract carefully and try to work with a credit card processing provider that offers a month-to-month agreement. If you’re unsure, have an expert review the contract before signing.

8. Minimum Monthly Fees

If you don’t process a certain dollar amount in transactions each month, you may be hit with a minimum processing fee—essentially a penalty for low sales volume.

For example, if your agreement requires $1,000 in monthly volume and you only process $500, the provider may charge you the difference in fees.

How to avoid it:

Look for providers with no monthly minimums or ones that scale fees according to your actual processing volume.

9. Cross-Border or International Fees

If you sell products or services to customers in other countries, you may incur cross-border fees or currency conversion fees, typically 1% to 3% of the transaction amount.

These charges often aren’t clearly explained upfront and can severely impact profit margins for international transactions.

How to avoid it:

Work with a provider that specializes in international payments or consolidates foreign currency fees into one transparent rate.

10. Junk Fees & Miscellaneous Charges

Some providers include vague fees such as:

-

AVS (Address Verification Service) Fees

-

Voice Authorization Fees

-

Monthly Access Fees

-

IRS Reporting Fees

These may appear sporadically on your statements and are often difficult to trace back to any meaningful service.

How to avoid it:

Review your monthly statements closely. At Renaissance Advisory, we help clients audit and interpret complex fee structures to ensure they’re not being overcharged.

Final Thoughts: Transparency is Power

Understanding the true cost of online credit card payment processing is essential to protecting your bottom line. Many of the hidden fees outlined above are avoidable—if you know what to look for and ask the right questions.

Before signing any contract, always ask for a complete fee disclosure and review it thoroughly. Better yet, work with an advisor who understands the industry.

At Renaissance Advisory, we specialize in helping businesses navigate the fine print, optimize their payment systems, and reduce unnecessary costs. If you’re unsure whether your current credit card processing provider is working in your favor, our experts can conduct a complimentary audit and provide honest, actionable feedback.

Looking for clarity in your payment processing strategy?

Visit Renaissance Advisory to schedule a consultation and take the first step toward smarter, more cost-effective payment solutions.