When running a business in North Carolina, keeping track of sales tax is one of those tasks that you simply cannot overlook. The North Carolina Sales Tax Calculator is a helpful tool designed to take the confusion out of this process. Whether you own a small boutique, manage an online store, or offer freelance services, staying compliant with North Carolina’s sales tax regulations is essential. The sales tax system in North Carolina includes both state and local tax rates, making it a little complex to figure out the exact amount you need to charge your customers or pay to the state. This is where a reliable tool like Otto AI’s North Carolina Sales Tax Calculator becomes valuable, saving time and reducing the chances of errors.

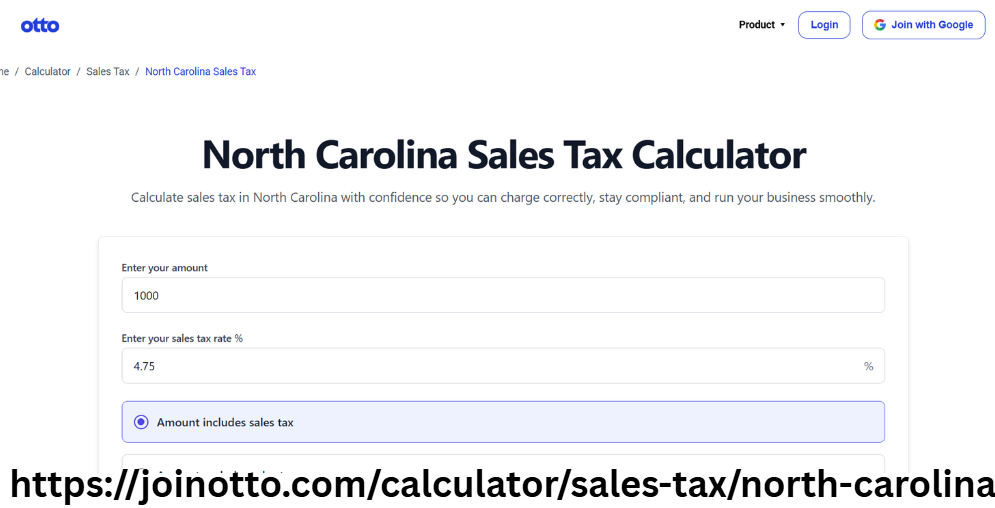

In North Carolina, the base state sales tax rate is 4.75%. However, each county can add its own local tax rate on top of the state rate, leading to varying total tax rates across different regions. For example, a product sold in one county might be subject to a 6.75% tax rate, while in another county, it could be 7.5% due to the added local taxes. If you are a business owner or self-employed entrepreneur, manually calculating these variations every time can become overwhelming. The sales tax calculator North Carolina tool by Otto AI simplifies this task by instantly providing accurate results based on the latest tax rates.

One of the key challenges for entrepreneurs is staying updated with changing tax rates. Counties can update their local tax rates, and missing these updates can result in undercharging or overcharging customers. Both scenarios are risky—undercharging might lead to penalties, while overcharging could damage your reputation. With Otto AI’s sales tax calculator North Carolina, you can avoid these issues because the tool always reflects the most recent tax regulations, ensuring you are compliant without having to spend hours checking government websites or tax bulletins.

For e-commerce businesses that sell across multiple North Carolina counties, keeping track of destination-based sales tax rules becomes crucial. In North Carolina, sales tax is calculated based on where the product is delivered, not where your business is located. So, if you ship products to different counties, you must apply the correct tax rate for each destination. This complexity can lead to confusion, especially for businesses with high transaction volumes. Otto AI’s sales tax North Carolina calculator streamlines this process by allowing you to enter the delivery location and sales amount, instantly giving you the correct tax figure.

Another advantage of using a digital calculator for sales tax is the reduction in human errors. Manually applying tax rates, especially when they vary by location, increases the chance of mistakes in billing or accounting. Even a small miscalculation can cause discrepancies in financial records, leading to complications during audits or tax filing. With Otto AI’s North Carolina Sales Tax Calculator, accuracy becomes a given, helping business owners maintain clean and compliant financial records.

Freelancers and service providers often wonder if sales tax applies to their services. In North Carolina, many professional services are not subject to sales tax, but some tangible personal property or certain digital products are taxable. Navigating these exceptions can be tricky, especially for new business owners. Otto AI’s calculator helps by clearly distinguishing taxable items and services, providing clarity on what portion of a transaction requires sales tax to be collected.

Invoicing becomes much easier when you have a precise tax figure to add. You no longer have to second-guess or cross-reference tax charts manually. Just input the sales amount and location into the sales tax calculator North Carolina and you get an exact breakdown of subtotal, tax, and total amount due. This not only speeds up the billing process but also adds professionalism to your invoices.

For small businesses aiming to scale, managing taxes manually is not sustainable. As your customer base grows, so does the complexity of managing transactions in different counties. A dependable tool like Otto AI’s North Carolina Sales Tax Calculator can grow with your business, handling increased data inputs without compromising on speed or accuracy. You can focus on growing your business while the calculator takes care of the tax details behind the scenes.

Moreover, tax compliance is not just about calculations; it’s also about record-keeping. Having an organized system to track tax amounts collected and paid is vital for smooth financial operations. Otto AI’s calculator not only helps you with daily sales tax calculations but also assists in maintaining consistent records, which proves helpful during tax season or financial reviews.

For entrepreneurs who are always on the move, having access to a mobile-friendly tax calculator is a game-changer. Otto AI’s sales tax calculator North Carolina is designed to be accessible from any device, whether you’re using a laptop in your office or a smartphone while attending a trade show. This flexibility ensures that you are never caught off-guard when you need to calculate sales tax on the go.

It’s common for business owners to feel anxious about sales tax audits, especially when their tax filings are not in order. Mistakes in sales tax collection can trigger unwanted scrutiny. However, by using a reliable and accurate calculator, you significantly minimize these risks. Otto AI’s North Carolina Sales Tax Calculator acts like a built-in compliance assistant, giving you peace of mind knowing your calculations are consistently accurate and up-to-date.

Another benefit is the time-saving aspect. Instead of spending hours on manual tax calculations or double-checking spreadsheets, you can get instant results within seconds. This means less time spent on administrative tasks and more time focusing on what truly matters—serving your customers and growing your business. Otto AI understands how valuable your time is, which is why the sales tax North Carolina calculator is designed to deliver fast and reliable outputs with minimal input.

New business owners often face a learning curve when it comes to understanding state and local tax rules. The calculator serves as a learning tool as well, helping users get familiar with North Carolina’s sales tax structure through hands-on use. Over time, you’ll develop a better understanding of how tax rates impact your pricing strategies and overall business finances.

For those offering discounts or running promotional offers, calculating sales tax on discounted prices can also get tricky. Otto AI’s calculator takes this into account, ensuring that even with dynamic pricing models, your sales tax figures remain accurate. Whether you’re running a weekend sale or offering bulk purchase discounts, the calculator adjusts the tax accordingly.

In conclusion, using a North Carolina Sales Tax Calculator is no longer a luxury but a necessity for businesses that want to stay compliant and efficient. Otto AI’s tool is designed to handle the complexities of varying tax rates, destination-based tax rules, and changing regulations with ease. For small business owners, self-employed professionals, and entrepreneurs, this calculator becomes a daily companion that simplifies tax calculations and ensures accuracy. By integrating this tool into your daily operations, you can focus more on growing your business and less on worrying about tax mistakes. With Otto AI’s North Carolina Sales Tax Calculator, managing sales tax becomes a seamless part of your workflow, keeping you compliant and confident every step of the way.