Medium Density Fiberboard Market: Trends, Opportunities, and Future Outlook

Market Estimation & Definition

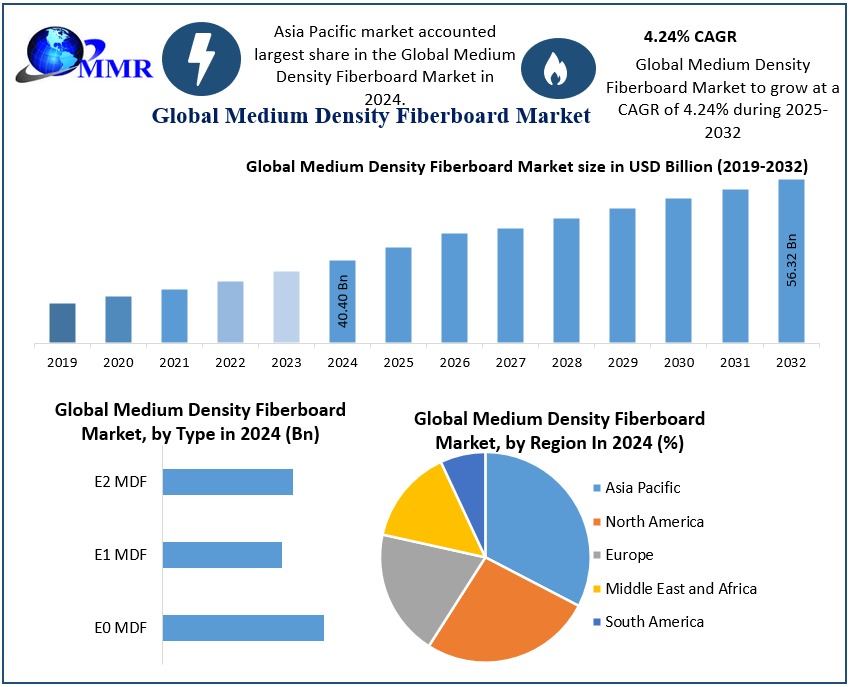

The Medium Density Fiberboard Market was valued at USD 40.40 billion in 2024 and is projected to reach USD 56.32 billion by 2032, growing at a CAGR of 4.24% during the forecast period. MDF is an engineered wood product made by breaking down hardwood or softwood residuals into wood fibers, combining it with wax and resin binders, and forming panels by applying high temperature and pressure. Known for its smooth surface and uniform density, MDF is widely used in furniture manufacturing, interior decoration, and building materials.

Market Growth Drivers & Opportunities

The growth of the MDF market is primarily driven by the rising demand in new domestic housing construction and commercial constructions. Modern furniture trends favor materials that offer high temperature resistance, fire resistance, moisture resistance, and durability—all characteristics inherent to MDF. Additionally, the increasing inclination towards stylish and functional furniture has boosted the demand for MDF in interior decoration.

Innovations in product development, such as moisture-resistant and fire-resistant MDF, have expanded its applications in environments like laboratories, laundry areas, and areas prone to humidity. The European Union’s establishment of the Euroclass classification system for fire resistance has further standardized the use of fire-resistant MDF panels, enhancing safety and compliance in construction projects.

Ask for Sample to Know US Tariff Impacts on Market @ Sample Link :https://www.maximizemarketresearch.com/request-sample/13521/

Emerging Trends Shaping the Future

- Construction Boom and Material Innovation: The revitalization of Europe’s construction industry and rapid expansion in the Asia Pacific region are fueling the demand for MDF in furniture, flooring, and cabinet manufacturing.

- Eco-Friendly Materials: The shift towards sustainable and recyclable wood-based products is influencing consumer preferences, leading to increased demand for eco-friendly MDF in construction and furniture applications.

- Technological Advancements: Companies are investing in research and development to produce MDF panels with enhanced features, such as anti-fingerprint surfaces and improved durability, catering to the evolving needs of consumers and industries.

Segmentation Analysis

- By Type:

- E0 MDF: Low formaldehyde emission, suitable for environments with strict health and safety standards.

- E1 MDF: Moderate formaldehyde emission, commonly used in furniture manufacturing.

- E2 MDF: Higher formaldehyde emission, used in applications where emission levels are less critical.

- By Application:

- Furniture Industry: Dominates the market with a 60.4% share in 2023, driven by the demand for lightweight, durable, and aesthetically pleasing furniture.

- Building Materials: Utilized in construction for its strength and versatility.

- Interior Decoration: Preferred for decorative elements due to its smooth finish and ease of customization.

- Others: Includes applications in packaging, automotive, and other industries.

Country-Level Analysis

- USA: The U.S. market is influenced by stringent regulations on formaldehyde emissions, guided by collaborations between the Environmental Protection Agency and the Composite Panel Association. These regulations aim to protect workers from health hazards associated with formaldehyde, promoting the use of low-emission MDF products.

- Germany: Germany contributes to 10% of the global demand for wood-based panels, primarily driven by the robust furniture and construction industries. The country’s emphasis on home décor and luxury furniture, coupled with government investments in infrastructure, is expected to boost MDF demand in the construction sector.

Competitive Landscape

The global MDF market is characterized by the presence of numerous key players focusing on product innovation and expansion strategies. Notable companies include:

- Accsys Technologies (UK)

- ARAUCO (Chile)

- Carter Holt Harvey Limited (New Zealand)

- Duratex (Brazil)

- Fantoni (Italy)

- Kronospan M&P Kaindl (Austria)

- Swiss Krono Group (Switzerland)

- Sonae Industria (Portugal)

- Kastamonu Entegre (Turkey)

- Egger (Austria)

- Pfleiderer (Germany)

- Norbord (Canada)

- Georgia-Pacific Wood Products (USA)

- Dongwha (South Korea)

- Guodong Group (China)

- Furen Group (China)

- DareGlobal Wood (China)

These companies are investing in advanced manufacturing technologies and expanding their product portfolios to meet the growing demand for specialized MDF products.

Press Release Conclusion

The Medium Density Fiberboard market is poised for significant growth, driven by the surge in construction activities, evolving consumer preferences, and advancements in product development. As industries and consumers increasingly seek sustainable, durable, and versatile materials, MDF stands out as a preferred choice in furniture manufacturing, interior decoration, and building materials. With continuous innovations and a focus on eco-friendly solutions, the MDF market is set to experience robust growth in the coming years.