India Air Conditioners Market Forecast Report (2024–2032)

By Types (Room, Ducted, Ductless, Centralized), Product Types (Split, Window, Others), Capacity (1 Ton, 1.5 Ton, 2 Ton, Others), Applications, Sales Channels, Regions & Key Companies

Market Overview

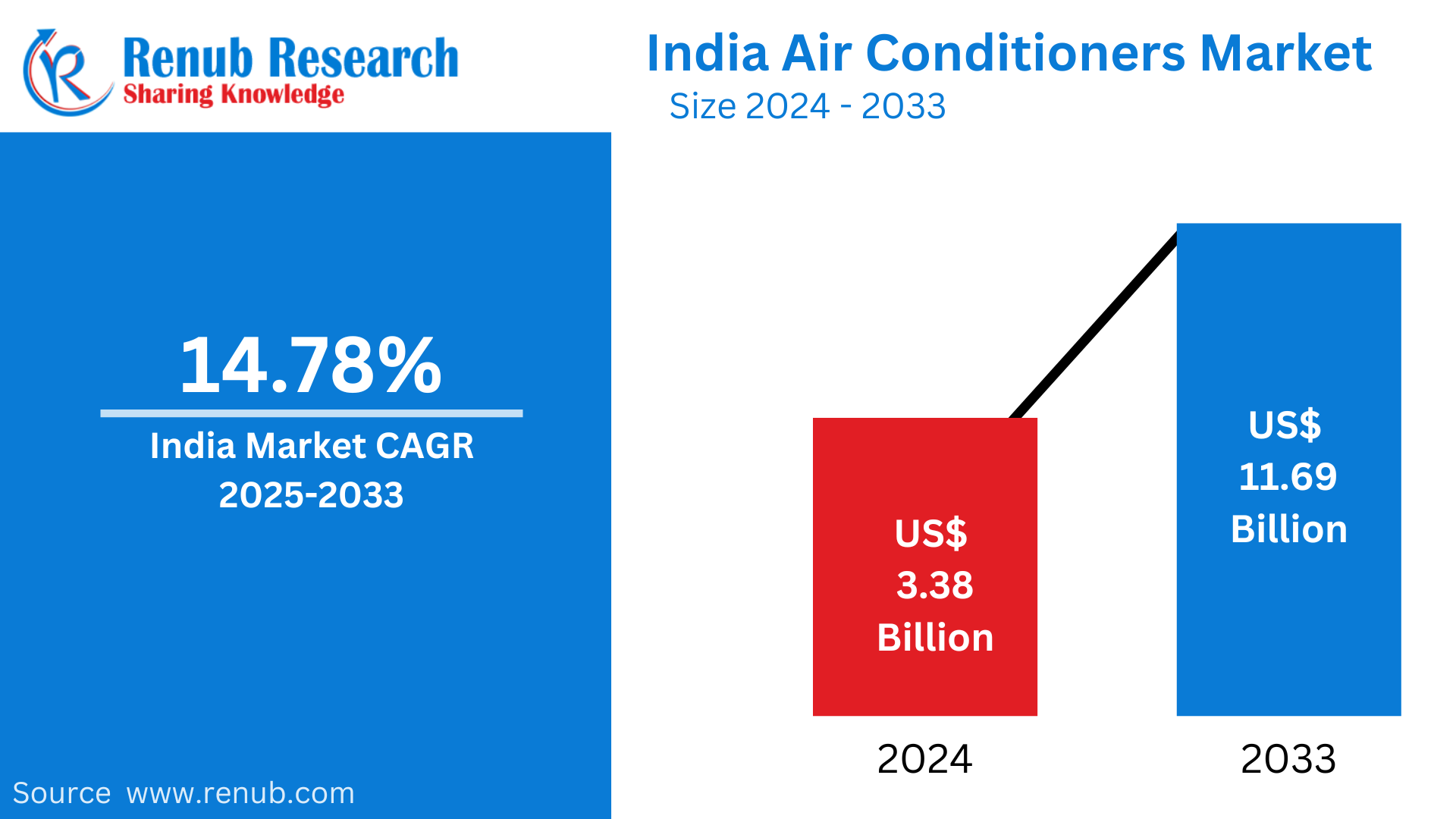

The India Air Conditioners Market was valued at US$ 3.38 Billion in 2023, and is projected to reach US$ 11.69 Billion by 2032, growing at a CAGR of 14.78% from 2024 to 2032. This robust growth is primarily driven by rapid urbanization, rising middle-class income, changing climatic conditions, and increased housing construction, especially in tier-2 and tier-3 cities.

The proliferation of modern infrastructure, expansion of the retail sector, and government initiatives like “Housing for All” and the “Smart Cities Mission” are further fueling demand for energy-efficient and smart air conditioning systems.

Market Drivers and Trends

- Urbanization & Changing Consumer Lifestyles

With millions migrating to urban areas in search of better opportunities, there has been a significant rise in disposable income and a shift in lifestyle preferences. Air conditioners, once considered a luxury, are now a necessity in Indian homes—especially in metro and tier-2 cities facing intense summer heat.

- Growth in Real Estate and Smart Housing Projects

New residential developments, commercial spaces, and smart city projects are incorporating AC installations as a standard offering. Builders now include split and centralized AC systems as part of home and office offerings to cater to growing demand for convenience, comfort, and efficiency.

- Technological Advancements & Energy Efficiency

Manufacturers are developing smart ACs integrated with IoT, AI, and energy-saving technologies. These ACs come equipped with voice control, inverter technology, 7-in-1 convertibles, and eco-friendly refrigerants. Government mandates and customer awareness are pushing companies to offer sustainable and efficient models.

- E-commerce Penetration & Multi-Channel Retailing

Digital transformation in retail has reshaped the AC market. Online platforms offer detailed comparison tools, financing options, doorstep delivery, and installations, making ACs more accessible to a wider population. Modern trade outlets and multi-brand outlets (MBOs) also serve as critical sales enablers.

Market Challenges

- High Initial Cost: Despite growing demand, upfront costs and installation expenses remain a challenge for lower-income segments.

- Power Supply Limitations: In semi-urban and rural areas, inconsistent electricity supply hinders AC usage.

- Environmental Regulations: Shifting to eco-friendly refrigerants requires R&D investment, impacting smaller manufacturers.

Related Reports

Middle East Air Conditioner Market

Segmental Analysis

By Type

- Room Air Conditioners dominate the market due to their affordability and ease of installation.

- Ducted and Ductless ACs are gaining traction in commercial buildings and luxury apartments.

- Centralized ACs are increasingly used in malls, hospitals, and large-scale infrastructures.

By Product Type

- Split ACs hold the majority share thanks to their aesthetic appeal, silent operation, and higher efficiency.

- Window ACs remain popular in budget and rental housing segments.

- Others include portable and hybrid ACs, gradually picking up in niche markets.

By Capacity

- 1.5 Ton ACs are the most in-demand, especially for standard-sized bedrooms and office spaces.

- 1 Ton and 2 Ton models cater to small and large space requirements respectively.

By Application

- Residential Sector leads the market due to increased homeownership and consumer lifestyle upgrades.

- Commercial & Retail, Hospitality, Healthcare, and Infrastructure sectors follow closely, driven by air quality needs, customer comfort, and regulatory standards.

By Sales Channel

- Modern Retail & MBOs offer experience zones, seasonal promotions, and post-sale service—key factors influencing buyer decisions.

- Online Sales Channels are growing rapidly with discounts, EMI options, and doorstep services.

- Small Retailers still have a strong foothold in rural and semi-urban areas.

Regional Analysis

North India

North India commands a significant market share due to harsh summer climates, growing urban centers like Delhi-NCR, and booming retail infrastructure. High penetration in both residential and commercial sectors, along with strong distributor networks, supports consistent growth.

South, West & East India

- South India benefits from tech hubs like Bengaluru and Hyderabad, and higher average temperatures.

- West India, including Mumbai and Pune, has seen demand surge in both commercial and residential sectors.

- East India is an emerging market, supported by increasing disposable income and infrastructure projects.

Competitive Landscape

Major Players:

- Voltas Limited

- Blue Star Limited

- Havells India Limited

- Whirlpool of India Limited

- Godrej and Boyce Manufacturing Company Limited

- MIRC Electronics Limited

- Johnson Controls-Hitachi Air Conditioning India Limited

These players dominate the landscape with extensive product portfolios, distribution networks, and after-sales support. Companies are investing in R&D, local manufacturing, and customized products for Indian consumers.

Recent Developments

- Panasonic (Feb 2024) launched its Matter-enabled Room ACs with Miraie, including 60 new models with advanced inverter tech.

- Goodman (2024) introduced compact, side-discharge inverter ACs, focusing on quiet operation and space efficiency.

- Haier (2024) rolled out “super heavy-duty” Hexa inverter ACs with supersonic cooling, ideal for extreme conditions.

Key Questions Answered

- What is the current size of the India Air Conditioner Market?

→ US$ 3.38 Billion in 2023, projected to grow to US$ 11.69 Billion by 2032. - What is the forecast CAGR of the industry?

→ CAGR of 14.78% from 2024 to 2032. - Which product type is leading the market?

→ Split ACs dominate due to high efficiency and sleek designs. - Which capacity segment is most popular?

→ 1.5 Ton ACs due to suitability for mid-sized rooms and offices. - Which application dominates the industry?

→ Residential segment holds the highest market share. - Which region contributes the most to market share?

→ North India leads the market owing to climatic and population factors. - Who are the key players in the India AC Market?

→ Voltas, Blue Star, Havells, Whirlpool, Godrej, MIRC, Hitachi. - What are the main sales channels?

→ Online platforms, Modern Retail, Small Retailers. - How is real estate growth impacting the AC market?

→ Strongly positive, especially with integrated AC units in smart housing. - What role does technology play in market evolution?

→ Critical, as consumers prefer inverter tech, smart control, and energy-efficient models.

Report Details

| Feature | Description |

| Base Year | 2023 |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2032 |

| Market Coverage | Types, Product Types, Size, Applications, Channels, Regions |

| Format | PDF, Excel (PPT/Word on request) |

| Post-Sale Support | 1 Year |

| Customization | 20% Free |

Customization Services Available

- In-depth analysis of additional countries or states

- Competitive benchmarking

- Product lifecycle insights

- Channel performance analytics

- Trade, import-export, and production data