Life throws all kinds of expenses at us—some expected, some completely out of the blue. Whether it’s planning a dream wedding or dealing with a sudden hospital bill, having access to money at the right time can make all the difference. That’s exactly why many people in India have turned to a time-tested financial system: the Chit Fund.

Chit Funds have been around for generations, quietly supporting families, small businesses, and individuals with real financial needs. They’re not just about saving money—they’re about creating a support system that helps when life happens.

Let’s take a closer look at how real people use Chit Fund money for real-life goals—and how you can, too.

1. The Big Fat Indian Wedding – Paid in Peaceful Installments

Weddings in India aren’t just events. They’re festivals. From booking the venue and hiring photographers to finalizing the caterers, the bills pile up faster than you can say “shaadi.”

Many families use Chit Fund money to manage wedding expenses without taking on crushing loans. How?

Simple: they contribute a fixed amount each month, and when their turn comes up in the chit cycle, they take a lump sum—all at once. No high interest, no long waits. Just a smart way to plan ahead.

💡 Take Action with My Paisaa: Start a Chit today and get closer to your wedding goals—month by month, stress-free.

2. Emergency Medical Expenses – Because Life Doesn’t Warn You

A medical emergency doesn’t wait for your salary to arrive or your savings to build up. Whether it’s an accident, surgery, or a sudden health scare, expenses can be overwhelming.

This is where a Chit Fund becomes more than just a saving tool—it becomes a safety net. Being part of a chit group means you have access to money when you need it most, without the paperwork and pressure of a personal loan.

People have used chit payouts to cover emergency treatments, hospital stays, and medicines—proving that the right help at the right time can ease more than just financial pain.

💡 Your Safety Net Awaits: Join a Chit Fund on My Paisaa and stay prepared for life’s unexpected turns.

3. School and College Fees – A Parent’s Lifeline

Education is one of the biggest investments families make. And it’s not cheap—especially higher education. Instead of scrambling for funds every semester or taking on debt, many parents turn to Chit Funds.

With careful planning, a Chit Fund allows them to receive money at the start of the academic year, right when they need it most. This helps them avoid high-interest loans and gives peace of mind knowing their child’s education won’t be disrupted by money problems.

💡 Invest in Your Child’s Future: Use My Paisaa to start a chit tailored to your child’s education milestones.

4. Small Business Boost – Fuel for Local Entrepreneurs

Chit Funds aren’t just for personal goals—they’re a lifeline for small business owners and self-employed individuals. Need working capital? Want to expand your store? Waiting on customer payments?

Joining a chit group means you can access a lump sum without begging a bank or mortgaging your assets. Many traders, shopkeepers, and even freelancers use Chit Fund money to manage cash flow or invest in new opportunities.

💡 Fuel Your Business Dreams: My Paisaa helps you access funds when you need them most—no questions asked.

5. Home Renovations – Turn That Old House Into a Dream Home

Fixing a leaky roof, upgrading a kitchen, or painting the walls—all these home upgrades cost money. For many families, putting off repairs means watching their home slowly wear down. But with Chit Funds, they don’t have to wait.

By timing their chit payout with renovation plans, people have turned old, tired spaces into fresh, cozy homes—all without taking on expensive renovation loans.

💡 Make Your Home Shine: Plan your home improvement journey with a My Paisaa Chit today.

Why Chit Funds Work—When Banks and Loans Don’t

Let’s face it. Getting a loan from a bank isn’t always easy. The paperwork, the credit checks, the wait—it’s a hassle. But Chit Funds are simple. You join a group, contribute monthly, and when your turn comes, you get your money. You also have the option to bid early in case of urgent needs.

It’s not just about money—it’s about community. Everyone chips in, and everyone benefits. That’s the beauty of the Chit Fund model.

How to Start a Chit Fund Safely

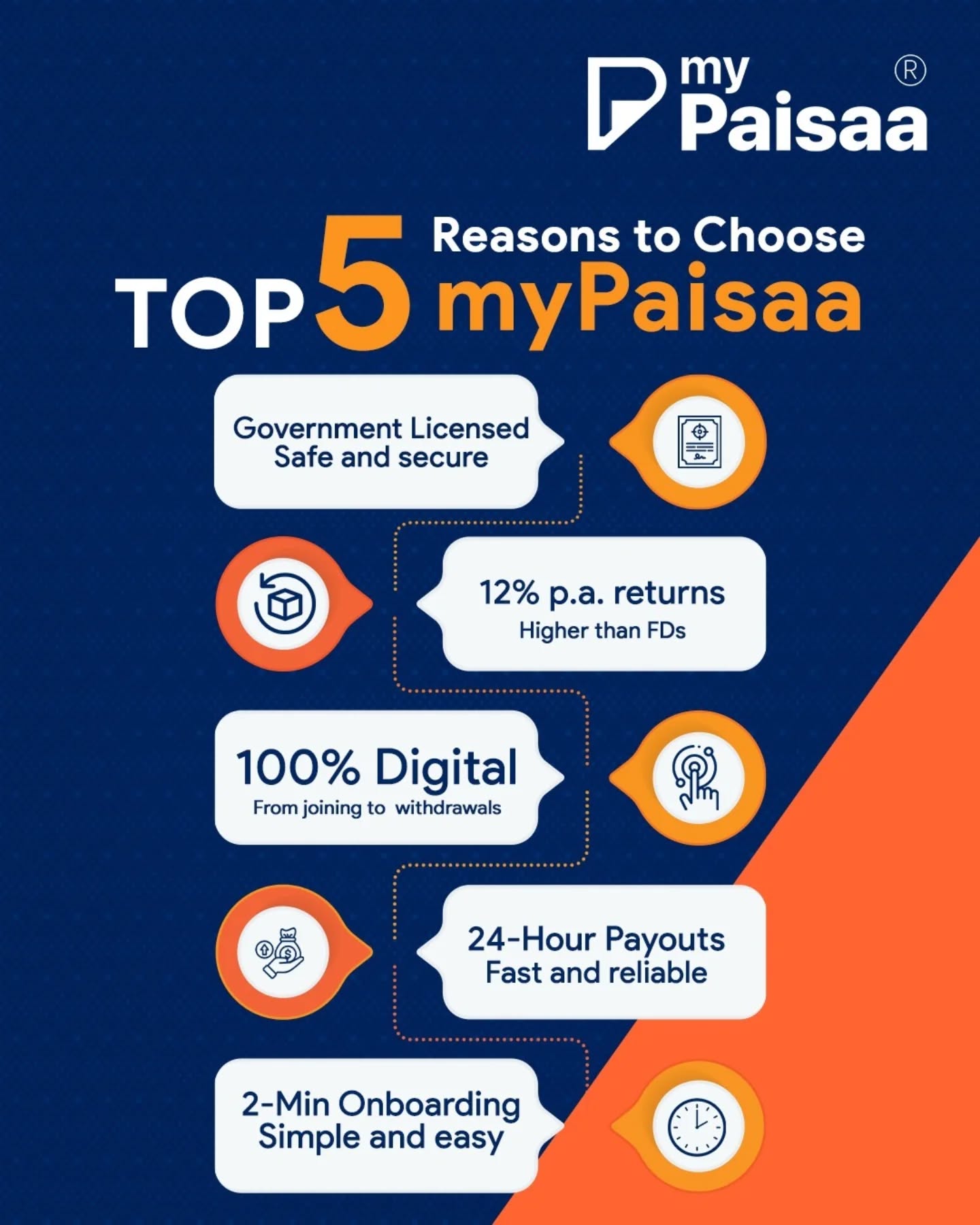

If you’ve never joined a Chit Fund before, you might wonder—is it safe? That’s where trusted digital platforms like My Paisaa come in.

With My Paisaa, you can:

-

Join government-registered Chit Funds

-

Track your payments and returns online

-

Choose chit plans based on your goals

-

Withdraw money when you need it most

No shady agents. No hidden charges. Just transparent, regulated, community-driven finance.

Final Thoughts

From dream weddings to tough emergencies, the Chit Fund is more than an old tradition—it’s a modern solution for real needs. It helps people save smartly, spend wisely, and live securely.

If you’re looking for a simple, flexible way to build your future—without high-interest loans or the red tape of banks—now’s the time to take charge.

🎯 Ready to Begin? Start your first Chit Fund with My Paisaa today and unlock a better way to save, grow, and achieve your goals.