Europe Footwear Market Overview

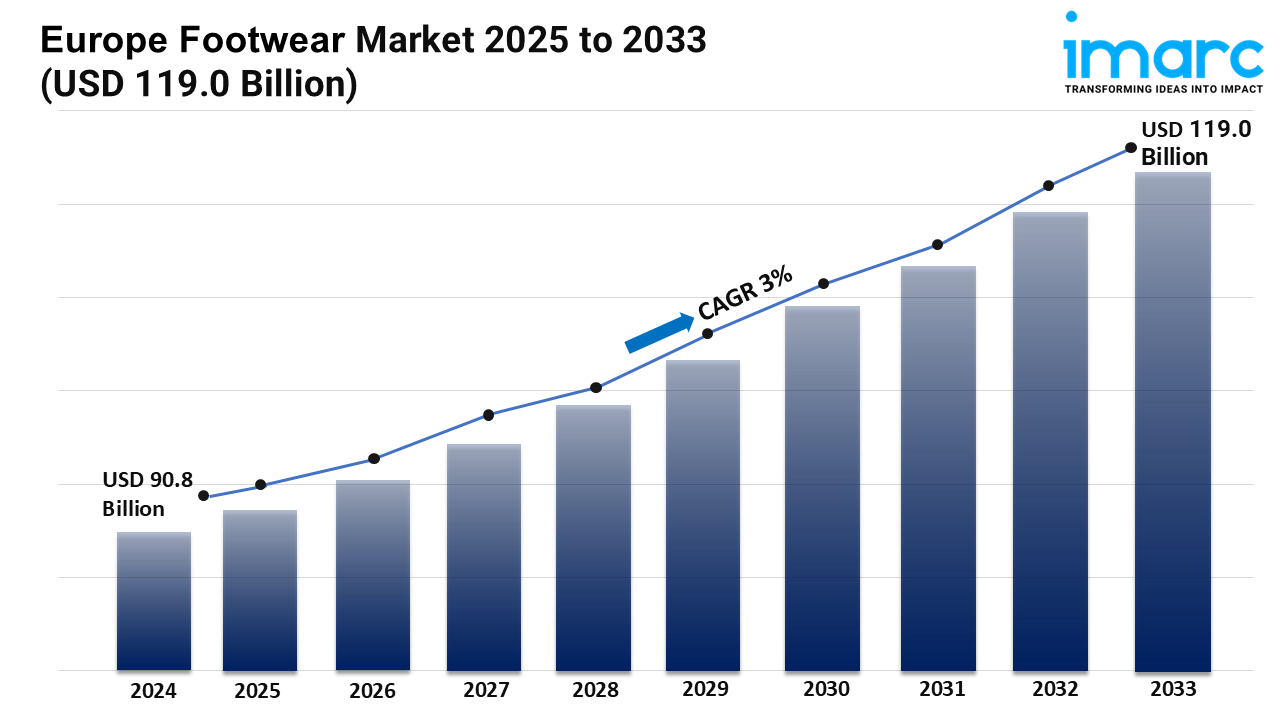

Market Size in 2024: USD 90.8 Billion

Market Forecast in 2033: USD 119.0 Billion

Market Growth Rate: 3% (2025-2033)

According to the latest report by IMARC Group, the Europe footwear market size was valued at USD 90.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 119.0 Billion by 2033, exhibiting a CAGR of 3% from 2025-2033.

Europe Footwear Industry Trends and Drivers:

Driven by a combination of changing consumer tastes and technological innovation, the European shoe industry is seeing strong growth. As more people adopt active lifestyles and give comfort along with style priority, rising health awareness is driving up demand for athletic shoes. Non-athletic shoes are also becoming more popular as a result of changing fashion trends that value premium fabrics and personalizing, therefore attracting a broad range of people including men, women, and children. Material technology breakthroughs are helping producers create lightweight, strong, and environmentally friendly goods using rubber, leather, polymers, and fabrics suited for particular performance and aesthetic demands. These inventions are not only improving product performance but also fitting with the increasing consumer need for sustainability and ethically made goods. Offering convenience, larger selections, and tailored shopping experiences, growing e-commerce platforms are helping consumers reach more markets. Omnichannel approaches are changing distribution channels like footwear experts, grocery shops, department stores, and clothing retailers to produce smooth buying experiences that help to sustain market growth. Moreover, growing disposable incomes throughout Europe are allowing customers to investigate premium and luxury shoe categories, therefore boosting the general market value.

Defining growth trajectories within the Europe footwear market is greatly influenced by market segmentation according to product type and substance. With inventions concentrating on performance-enhancing features, ergonomic designs, and better breathability, athletic footwear still gains from more involvement in sports and fitness events. As fashion-conscious customers look for flexible styles combining aesthetics with utility, non-athletic shoes are also growing. Material diversity is boosting product appeal; natural leather is still preferred for its luxury and endurance while synthetic materials provide affordability and sustainability advantages. Especially in sports footwear, rubber parts are critical for grip and flexibility; fabric integration helps lightness, comfort, and ventilation. The distribution ecosystem is broadening, with online sales channels witnessing rapid growth due to the ease of access and growing digital literacy among consumers. Particularly for premium products where customers want personalized service and tactile product experiences, traditional retail establishments including department stores and shoe specialists continue to be important touchpoints. Pricing techniques are changing to strike a compromise between exclusivity and affordability, hence mirroring the varied purchasing power found across European regions.

The growth dynamics and regional distribution of the European shoe industry are clearly affected by country-specific elements. Through strong manufacturing infrastructure and rising consumer spending on high quality and premium footwear items, Germany is leading innovation. Reflecting growing environmental consciousness among customers, the United Kingdom’s market is stressing ethical sourcing and sustainable production. Driven by its fashion-forward people and cultural affinity for luxury brands, France is seeing great demand for designer and luxury shoes. Rising tourism and seasonal retail cycles are helping Southern European nations to grow both their casual and formal shoe sectors. Eastern European markets are meanwhile experiencing fast urbanization and rising disposable incomes, which presents fresh prospects for mid-tier and mass-market shoe categories. Along the continent, ongoing digital transformation is improving customer engagement. Virtual try-on technologies and customized recommendations are becoming increasingly popular. Government policies encouraging regional manufacturing and sustainable fashion are further accelerating market growth. Together, these regional trends and consumer habits are supporting the optimistic forecast for the Europe footwear market and the sustained expansion over the projected period.

Download sample copy of the Report: https://www.imarcgroup.com/europe-footwear-market/requestsample

Europe Footwear Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product:

- Non-Athletic Footwear

- Athletic Footwear

Breakup by Material:

- Rubber

- Leather

- Plastic

- Fabric

- Others

Breakup by Distribution Channel:

- Footwear Specialists

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Online Sales

- Others

Breakup by Pricing:

- Premium

- Mass

Breakup by End User:

- Men

- Women

- Kids

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Europe Footwear Market News:

- In June 2024, Bata partnered with SARENZA.com in France, making their stylish and high-quality footwear accessible to French customers. Bata boutiques are now available in both sestiere San Marco and sestiere Cannaregio in Venice and Italy.

- In April 2024, Nike launched the Ultrafly Trail Racing Shoe, featuring a carbon Flyplate in the sole for enhanced speed, sleek design, and superior grip. The new performance trail runner will be available in limited quantities in Europe starting in July.

- In June 2023, The Re-Shoes LIFE project aims to offer a circular, sustainable solution for end-of-life footwear management. The European Platform for Sport Innovation (EPSI) will host the project’s launch event during the EPSI Annual Conference 2023. The event will take place in the Azores, Portugal, highlighting innovative approaches to sustainability in the footwear industry.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=2909&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145