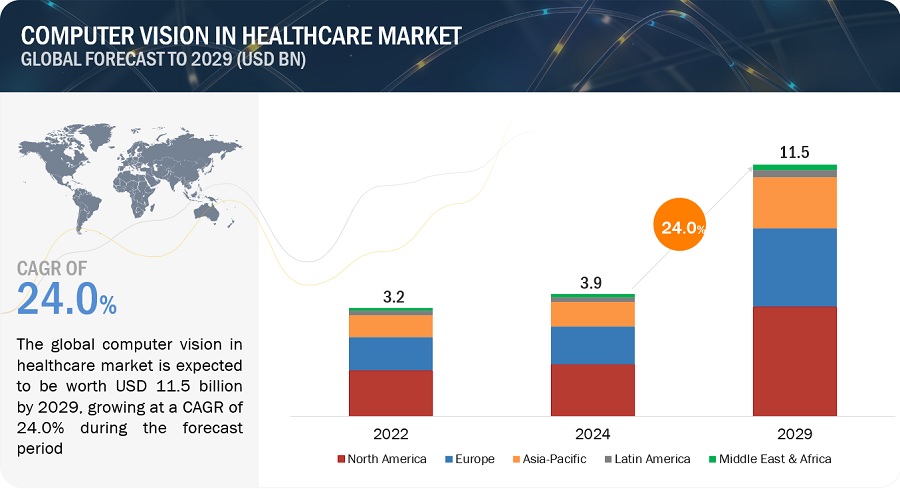

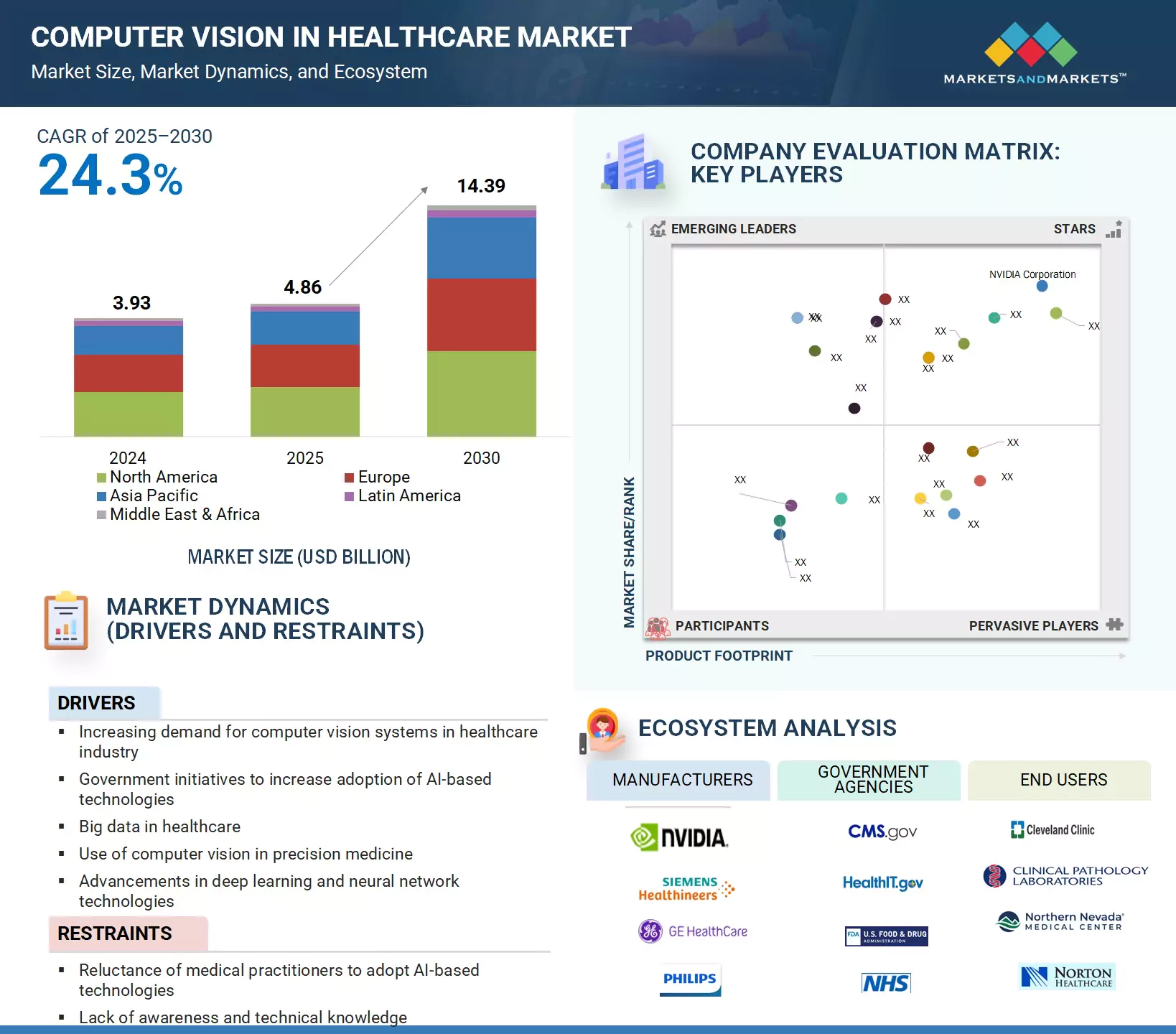

Computer Vision Healthcare Market growth forecasted to transform from USD 3.9 billion in 2024 to USD 11.5 billion by 2029, driven by a CAGR of 24.0%. Market growth is propelled by the regulatory initiatives and incentives promote the adoption of computer vision in healthcare. Regulatory agencies, such as the FDA and EMA, provide frameworks for validating and approving medical devices and software applications based on computer vision technologies. Nevertheless, challenges such as the complexity of integrating computer vision systems into existing healthcare infrastructures, shortage of skilled IT professionals and security concerns pose certain obstacles to the growth of the global computer vision in healthcare market. The market for computer vision in healthcare refers to the sector where computer vision technology is applied to various aspects of healthcare services, processes, and systems. This market is characterized by the intersection of advanced computer vision algorithms and applications with the diverse needs of healthcare providers, patients, and other stakeholders.

Browse in-depth TOC on “Computer Vision Healthcare Market”

505 – Tables

55 – Figures

379 – Pages

Key Market Players

The key players functioning in the computer vision in healthcare market include NVIDIA Corporation (US), Intel Corporation (US), Microsoft Corporation (US), Advanced Micro Devices, Inc. (US), Google, Inc. (US), Basler AG (Germany), AiCure (US), iCAD, Inc. (US), Thermo Fisher Scientific Inc. (US), SenseTime (China), KEYENCE CORPORATION (Japan), Assert AI (India), Artisight (US), LookDeep Inc. (US), care.ai (US), CareView Communications (US), VirtuSense (US), Teton (Denmark), viso.ai (Switzerland), NANO-X IMAGING LTD. (Israel), Comofi Medtech Pvt. Ltd. (India), Avidtechvision (India), Roboflow, Inc. (US), Optotune (US) and CureMetrix, Inc. (US).

Driver: The healthcare sector is experiencing a growing need for computer vision systems.

Over time, there has been a notable surge in the demand for AI-powered computer vision solutions within the healthcare sector. These solutions exhibit significant potential across various healthcare realms, ranging from clinical trials and precision medicine to the diagnosis of medical images. The advantages offered by AI-driven CV systems, such as enhanced patient care delivery, expedited and more accurate analysis of diagnostic images, improved medication adherence, and cost reduction, are compelling reasons behind the adoption of these solutions by diverse stakeholders in the healthcare industry.The growing integration of computer vision technology in healthcare aims to streamline decision-making processes, reduce human errors, and ultimately enhance the efficiency and efficacy of healthcare services. Given the benefits associated with AI-based computer vision in healthcare, an increasing number of academic institutions are opting to implement these solutions. For instance, in April 2024, CAD collaborated with RAD-AID to bolster breast cancer detection using AI technology in underserved regions and low- to middle-income countries (LMICs). Furthermore, in November 2023, ICAD’s AI-driven solutions facilitated the expedited detection of breast cancer through a partnership with GE Healthcare. These expanding partnerships are anticipated to drive market growth in the foreseeable future.

Restraint: The resistance of medical practitioners towards adopting AI-based technologies.

The significant expansion of digital health and mobile health technologies has empowered healthcare providers to introduce innovative treatment methods to assist patients. AI technologies provide doctors with valuable tools for diagnosing and treating patients more effectively. However, there exists an apparent reluctance among medical professionals towards embracing new technologies. Some practitioners hold the misconception that AI will gradually replace doctors in the future. Forecasts from the World Economic Forum in January 2016 predicted a loss of 5.1 million jobs across all sectors by 2020 due to AI technologies. However, in the healthcare sector, there is only a 0.42% probability, as indicated by a study from Oxford University published in September 2013, that physicians and surgeons will be replaced by AI by 2020.Moreover, there is a concern that patients might overly rely on these technologies, potentially leading them to forego necessary in-person treatments, which could strain long-standing doctor-patient relationships.Presently, many healthcare professionals harbor doubts about the accuracy of AI solutions in diagnosing patient conditions. This skepticism makes it challenging to persuade providers that AI-based solutions are cost-effective, efficient, and safe alternatives that not only provide convenience to doctors but also enhance patient care. Nevertheless, healthcare providers are gradually recognizing the potential benefits of AI-based solutions and the diverse range of applications they offer. Consequently, there is a likelihood that in the forthcoming decade, doctors will increasingly embrace AI-based technologies in healthcare.

Opportunity: Computer vision solutions for healthcare that are hosted in the cloud.

At present, numerous businesses are transitioning to the cloud to capitalize on advantages like simplified deployment, accelerated processing speeds, and user-friendly interfaces. In the context of computer vision solutions, deploying in the cloud enables end-users to access mission-critical data in real-time, presenting a significant advantage. Additionally, cloud-based computer vision solutions offer rapid and straightforward implementation, along with cost savings by eliminating infrastructure and maintenance expenses. Furthermore, they deliver scalability and flexibility to accommodate expanding user bases within organizations. As a result of these advantages, there is a growing demand among end-users for cloud-based computer vision solutions in the healthcare sector.

Challenge: Lack of curated data

The availability of comprehensive and well-organized data is essential for training and refining a robust AI system. Traditionally, datasets were predominantly structured and manually inputted. However, the proliferation of digital technologies, including IoT in healthcare, has led to the generation of vast amounts of data from interconnected health monitoring devices, Electronic Health Records (EHRs), and various other remotely connected healthcare equipment. Much of this imaging data lacks a coherent internal structure, making it challenging for developers to derive insights from it effectively. To train machine learning algorithms, developers require high-quality labeled data, often necessitating skilled human annotators. The process of extracting and labeling unstructured data demands a significant workforce and time investment.Furthermore, patient information is highly sensitive and subject to stringent privacy regulations. Legislation such as HIPAA and the HITECH Act mandates that entities handling sensitive health data implement measures to ensure its privacy and security. These entities are also required to notify patients in case of any breach compromising their information. Consequently, accessing curated data is challenging due to concerns regarding privacy, record identification, and security protocols.Therefore, structured medical imaging data plays a crucial role in the development of efficient AI-based computer vision systems. Companies are now exploring ways to derive insights from semi-structured data—a combination of structured and unstructured data—that facilitates information extraction through groupings and hierarchies. However, solutions and analytics tools for semi-structured data are still in their early stages of development.

“The largest share in the computer vision in healthcare market, based on type, was attributed to the PC-based computer vision systems segment in 2023.”

The PC-based computer vision systems segment holds the largest market share in the computer vision in healthcare market in 2023. The growth of this segment is propelled by factors such as PCs offering robust computational power, enabling real-time processing of complex algorithms required for tasks like medical image analysis. Also, PCs provide flexibility and scalability, allowing users to customize hardware configurations and software solutions according to specific requirements. This versatility makes them adaptable to various healthcare settings, from small clinics to large hospitals.

“North America accounted for the largest share of the healthcare simulation market in 2023.”

In 2023, North America held the largest share in the computer vision in healthcare market, with Europe and Asia Pacific following. The significant presence of North America in the global market can be attributed to factors such as region’s strong focus on improving patient outcomes and reducing healthcare costs which incentivizes the integration of computer vision solutions to streamline processes, enhance diagnostics, and optimize treatment pathways.

“In 2023, the patient activity monitoring/fall prevention segment demonstrated the most significant growth in the computer vision in healthcare market based on hospital management by type.”

The patient activity monitoring/fall prevention segment is expected to experience the highest growth in the computer vision in healthcare market. The key drivers for this growth include the aging population worldwide that has led to an increased focus on elderly care and fall prevention initiatives. Computer vision systems offer non-intrusive and continuous monitoring of patients’ movements, enabling early detection of potential fall risks and timely intervention to prevent accidents. Also, the growing adoption of wearable devices and smart sensors integrated with computer vision technology allows for seamless monitoring of patients’ activities both inside healthcare facilities and at home. This remote monitoring capability enhances patient safety and independence while reducing the burden on caregivers and healthcare resources.

Get 10% Free Customization on this Report

Recent Developments of Computer Vision In Healthcare Industry:

- In April 2024, iCAD partnered with RAD-AID to enhance breast cancer detection utilizing the AI technology in underserved regions and low- and middle-income countries (LMICs).

- In March 2024, Microsoft and NVIDIA have broadened their longstanding collaboration with robust new integrations that harness cutting-edge NVIDIA generative AI and Omniverse technologies across Microsoft Azure, Azure AI services, Microsoft Fabric, and Microsoft 365.

- In February 2022, Advanced Micro Devices acquired Xilinx. This acquisition established the forefront leader in high-performance and adaptive computing, with a significantly expanded scale and the most formidable portfolio of leadership computing, graphics, and adaptive SoC products in the industry.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/computer-vision-healthcare-market-231790940.html

https://www.marketsandmarkets.com/PressReleases/computer-vision-healthcare.asp