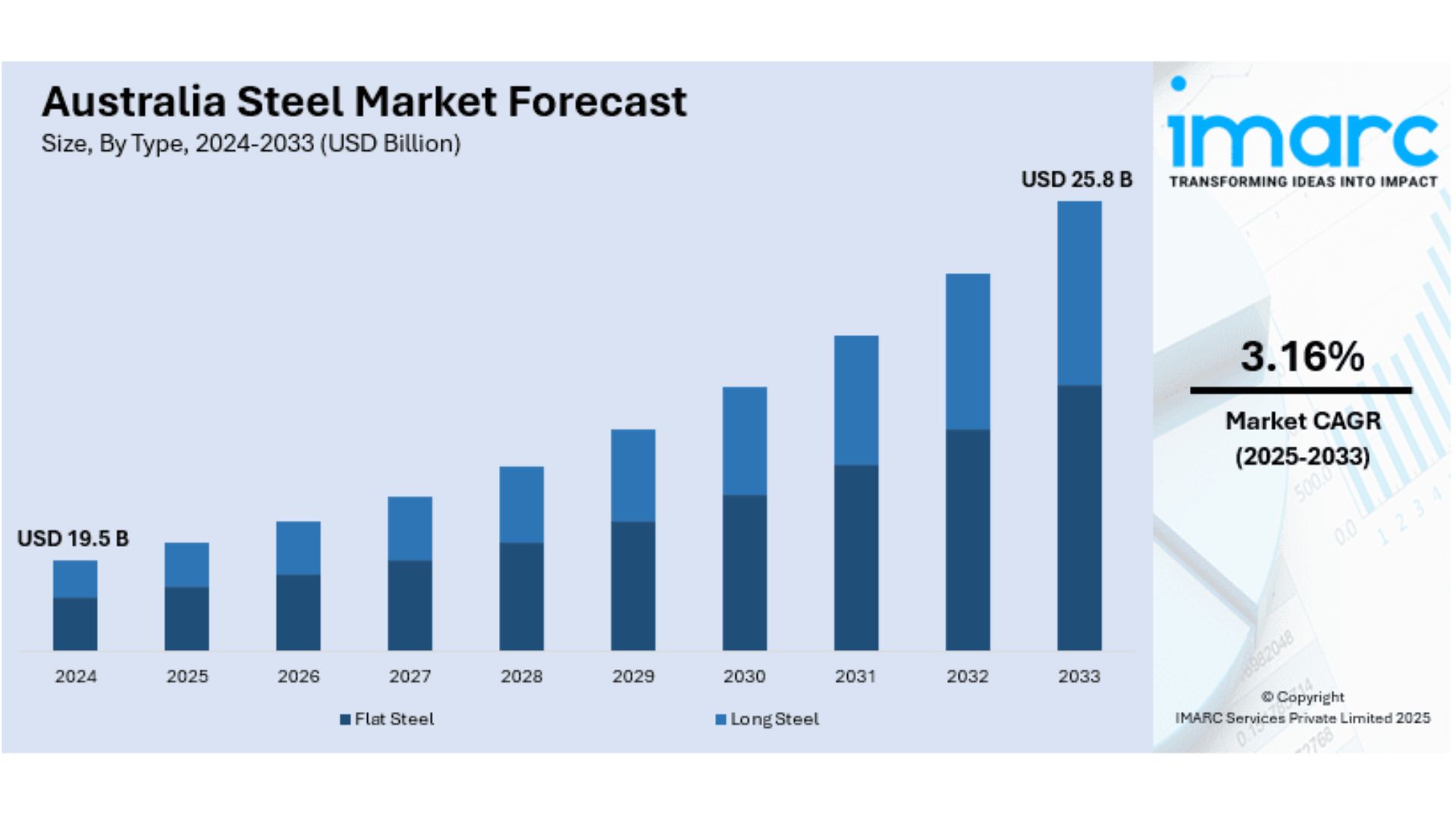

The latest report by IMARC Group, titled “Australia Steel Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” offers a comprehensive analysis of the Australia steel market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia steel market size reached USD 19.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.16% during 2025-2033.

Report Attributes:

- Base Year: 2024

- Forecast Years: 2025-2033

- Historical Years: 2019-2024

- Market Size in 2024: USD 19.5 Billion

- Market Forecast in 2033: USD 25.8 Billion

- Market Growth Rate 2025-2033: 3.16%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-steel-market/requestsample

How Is AI Transforming the Steel Industry in Australia?

Artificial intelligence is revolutionizing Australia’s steel manufacturing sector, driving efficiency, safety, and sustainability improvements across the production chain:

- Smart Manufacturing Integration: Australian steel producers are implementing Industry 4.0 technologies such as automation, robotics, IoT, also AI because it enables predictive maintenance so that it reduces material waste, together with streamlining operations through real-time data analysis.

- Quality Control Automation: AI-powered vision systems detect defects and quality issues inside steel products when they are in production, while they ensure consistent quality standards and reduce manual inspection requirements and human error.

Machine learning algorithms optimize blast furnace operations at Energy Optimization Systems since - they analyze patterns within temperature, pressure, and chemical composition so energy consumption reduces to achieve maximum efficiency.

- AI systems do monitor equipment health now in real-time within steel manufacturing facilities. These systems do predict potential failures and are thereby minimizing unplanned downtime along with extended equipment lifespan.

Australia Steel Market Overview

The Australian steel sector is experiencing steady growth driven by infrastructure development, government support, and technological modernization:

- Infrastructure-Driven Demand: Major construction projects with transportation networks with renewable energy installations sustain demand for structural steel because the construction sector consumes 52% of global steel.

- Through grants, procurement mandates, plus anti-dumping measures, the Modern Manufacturing Strategy and local procurement preferences are encouraging domestic steel production coupled with providing market stability.

- Australian steel producers invest in cleaner technologies so they produce steel sustainably. They also recycle steel above 90% into new products showing commitment to the environment.

- Australian steel producers access growing Southeast Asian markets by tactically positioning themselves geographically since these markets industrialize and rapidly develop infrastructure.

- For Technology Modernization Steel manufacturers embrace digital transformation and they implement smart manufacturing systems in order to improve operational efficiency along with product quality while they reduce environmental impact.

Key Features and Trends of Australia Steel Market

Current market dynamics reflect significant shifts toward sustainability, technology integration, and value-added production:

- High-Performance Steel Development: Manufacturers are focusing on specialty steels including wear-resistant, corrosion-proof, and lightweight alloys for defense, mining, and renewable energy applications, moving up the value chain

- Circular Economy Practices: Steel recycling technologies are advancing rapidly, with Australian facilities achieving industry-leading recycling rates while reducing dependence on raw materials and minimizing carbon footprints

- Smart Manufacturing Adoption: Real-time monitoring systems, automated quality control, and data-driven production optimization are becoming standard practices across major steel manufacturing facilities

- Regional Export Diversification: Australian steel producers are expanding into Southeast Asian markets, leveraging shorter shipping routes and stable trade relationships to balance domestic demand fluctuations

- Green Hydrogen Integration: Steel companies are exploring hydrogen-based production methods as alternatives to traditional coking coal, aligning with national carbon reduction targets and clean energy initiatives

Growth Drivers of Australia Steel Market

- Infrastructure Investment Surge: Government commitments to transportation, renewable energy, and urban development projects are creating consistent long-term demand for construction and structural steel across major cities

- Renewable Energy Expansion: Wind turbines, solar panel structures, battery storage systems, and hydrogen production facilities require specialized steel components, driving demand for high-performance materials

- Domestic Manufacturing Revival: Strategic government policies including the Modern Manufacturing Strategy and defense procurement preferences are supporting local steel production and reducing import dependency

- Population and Urbanization Growth: Expanding populations in Sydney, Melbourne, and Brisbane are driving residential and commercial construction activities, requiring substantial steel volumes for building frameworks and infrastructure

- Export Market Opportunities: Growing infrastructure development in Indonesia, Vietnam, and the Philippines presents significant export opportunities for Australian steel producers seeking revenue diversification

Innovation & Market Demand of Australia Steel Market

Technological advancement and market evolution are creating new opportunities for Australian steel producers:

- Advanced Metallurgy Research: Investment in research and development is producing next-generation steel alloys with enhanced strength, durability, and corrosion resistance for specialized applications in marine and aerospace sectors

- Carbon Capture Technologies: Steel producers are implementing carbon capture and storage systems to reduce emissions while maintaining production capacity, supporting both environmental goals and operational efficiency

- Additive Manufacturing Integration: 3D printing technologies are enabling custom steel component production for specialized applications, reducing waste while creating new market segments for precision-engineered products

- Digital Supply Chain Management: Blockchain and IoT technologies are improving traceability, quality assurance, and logistics efficiency throughout the steel supply chain from raw materials to end users

- Collaborative Innovation Partnerships: Steel manufacturers are partnering with universities, research institutions, and technology companies to accelerate innovation in production methods, materials science, and sustainability practices

Australia Steel Market Opportunities

Emerging opportunities are creating pathways for growth and market expansion across various industrial sectors:

- Defense and Security Applications: Growing defense spending and strategic autonomy initiatives are creating opportunities for specialized steel products in military equipment, naval vessels, and security infrastructure

- Mining Equipment Manufacturing: Australia’s mining sector expansion requires durable, high-strength steel for equipment, infrastructure, and processing facilities, presenting consistent demand for premium steel products

- Hydrogen Economy Development: The emerging hydrogen industry requires specialized steel for storage tanks, pipelines, and production equipment, creating new market segments for corrosion-resistant materials

- Smart City Infrastructure: Urban development projects incorporating smart technologies require advanced steel solutions for sensor networks, communication systems, and intelligent building frameworks

- Automotive Industry Revival: Government support for electric vehicle manufacturing and automotive industry development presents opportunities for lightweight, high-strength steel applications in vehicle production

Australia Steel Market Challenges

Several obstacles continue impacting market growth and operational efficiency across the steel sector:

- High Energy Costs: Australian steel manufacturers face some of the world’s highest electricity and gas rates, directly impacting operational profitability and competitive positioning against low-cost international producers

- Skilled Labor Shortages: Critical roles including welders, metallurgists, and systems engineers are increasingly difficult to fill due to aging workforce demographics and declining interest in trade professions among younger workers

- Global Price Volatility: International supply chain disruptions, geopolitical tensions, and trade wars create significant price instability for raw materials including iron ore and coking coal, affecting production planning and profitability

- Environmental Compliance Costs: Increasing regulatory pressure for emissions reduction and environmental standards requires substantial capital investment in cleaner technologies and production process upgrades

- Import Competition: Unfair foreign competition from subsidized steel producers continues challenging domestic manufacturers despite anti-dumping measures and government support initiatives

Australia Steel Market Analysis

Current market conditions reflect both significant opportunities and operational challenges requiring strategic adaptation:

- Government Support Implementation: The $200 million federal funding commitment is supporting major projects including BlueScope’s blast furnace upgrades and LIBERTY Steel’s green iron initiatives, demonstrating strong policy backing

- Market Concentration Trends: Major players including BlueScope Steel, InfraBuild, and LIBERTY Steel are consolidating market share while investing in technology upgrades and sustainability initiatives

- Import Surge Impact: A 50% increase in fabricated steelwork imports over recent years is intensifying competition for domestic producers, particularly in value-added product segments

- Export Performance Variability: BlueScope Steel’s US operations are benefiting from potential tariff protections, while regional export opportunities continue expanding in Southeast Asian markets

- Technology Investment Acceleration: Industry-wide adoption of smart manufacturing technologies, predictive maintenance systems, and energy optimization solutions is improving operational efficiency and competitiveness

Australia Steel Market Segmentation:

- By Type:

- Flat Steel

- Long Steel

- By Product:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

- By Application:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

- By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Steel Market News & Recent Developments:

2024: The Australian government announced $200 million in funding to future-proof regional steel manufacturing, supporting BlueScope’s blast furnace upgrade at Port Kembla and LIBERTY Steel’s transition to green iron production.

November 2024: InfraBuild acknowledged that 2024 has been a challenging year that tested the resilience of the Australian steel industry amid global supply chain pressures and market volatility.

February 2025: BlueScope Steel shares reached their highest level in over two months due to expectations that US tariffs on steel imports would benefit their American operations.

Australia Steel Market Key Players:

- BlueScope Steel Limited

- InfraBuild

- LIBERTY Steel Group

- Australian Steel

- Greensteel Australia

- Southern Steel Group

- Swiss Steel Group

- Vulcan Australia

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31666&flag=E

FAQs: Australia Steel Market

Q1: What was the Australia steel market size in 2024?

A: The market reached USD 19.5 Billion in 2024.

Q2: What is the expected market value by 2033?

A: The market is projected to reach USD 25.8 Billion by 2033.

Q3: How is AI transforming the steel industry in Australia?

A: AI is enabling smart manufacturing through predictive maintenance, quality control automation, energy optimization systems, and real-time production monitoring, improving efficiency and reducing operational costs.

Q4: What are the main growth drivers for this market?

A: Infrastructure investment surge, renewable energy expansion, domestic manufacturing revival, population growth, and export market opportunities in Southeast Asia are the primary drivers.

Q5: Which steel applications show the strongest demand growth?

A: Building and construction applications dominate with 52% of demand, followed by renewable energy infrastructure, mining equipment, and specialized defense applications showing rapid growth.

Conclusion of Report:

Australia’s steel market is navigating transformation while addressing global challenges and domestic opportunities:

- Government Support Acceleration: Federal funding of $200 million is supporting industry modernization and sustainability initiatives across major steel manufacturers

- Technology Integration Success: Smart manufacturing adoption is improving operational efficiency, quality control, and predictive maintenance capabilities throughout the sector

- Sustainability Leadership: Over 90% steel recycling rates and green hydrogen initiatives are positioning Australian producers as environmental leaders in global markets

- Export Diversification Progress: Strategic expansion into Southeast Asian markets is reducing dependency on domestic demand while leveraging geographic advantages

- Infrastructure Demand Stability: Ongoing construction, renewable energy, and transportation projects are providing consistent long-term demand for steel products

- Competitive Positioning: Despite energy cost challenges, Australian steel producers are maintaining market position through innovation, quality focus, and government policy support

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302