Australia Private Equity Market Overview

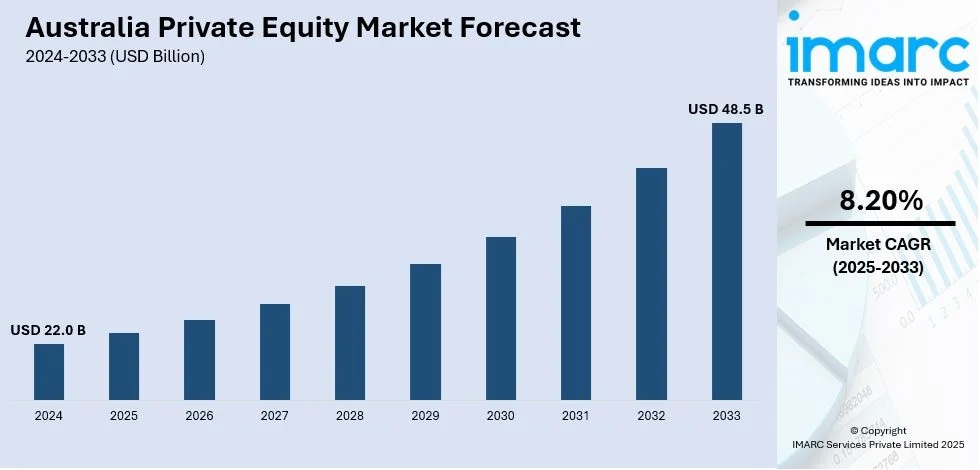

Market Size in 2024: USD 22.0 Billion

Market Size in 2033: USD 48.5 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group’s latest research publication, “Australia Private Equity Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The Australia private equity market size was valued at USD 22.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 48.5 Billion by 2033, exhibiting a CAGR of 8.20% during 2025-2033.

How Superannuation Power and ESG Innovation Are Transforming Australia’s Private Equity Future

- Superannuation Fund Revolution: Australian super funds are driving unprecedented market expansion with BCG forecasting private equity investments reaching USD 185 billion by 2025, as major funds like Rest manage USD 59.52 billion across 2 million members while increasing infrastructure and alternative asset allocations.

- ESG-Driven Deal Making: Environmental, Social, and Governance factors are reshaping investment strategies, with AU$4.2 trillion in superannuation assets under management prioritizing sustainable investments, while the government’s AU$1 billion Green Iron Investment Fund supports early-stage green manufacturing projects.

- Infrastructure Investment Surge: Major transactions like I Squared Capital’s USD 300 million partnership with Rest Superannuation focus on digital infrastructure, transportation, and renewable energy, while strategic mergers like ISPT joining IFM Investors accelerate growth in sustainable infrastructure projects.

- Mid-Market Opportunity Focus: Private equity firms are targeting small and mid-cap companies for enhanced agility and growth potential, leveraging operational improvements and bolt-on acquisitions as interest rates stabilize and dry powder deployment becomes more strategic across healthcare, technology, and renewable energy sectors.

- Creative Exit Strategy Innovation: With subdued IPO markets, Australian PE firms are pioneering alternative exits through partial sell-downs, secondary transactions, and backdoor listings, while secondary deals now account for significant sponsor exits as the market matures and buyer interest increases substantially.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-private-equity-market/requestsample

Australia Private Equity Market Trends & Drivers:

Australia’s private equity landscape is experiencing a fundamental transformation driven by the powerful combination of superannuation fund capital and regulatory evolution. The sheer scale of Australia’s superannuation system, with industry funds increasing their market share to 40% while managing over AU$4.2 trillion in assets, is creating unprecedented opportunities for private equity deployment. Eight mega funds now exceed $100 billion in assets each, providing the capital base necessary for large-scale infrastructure and alternative investments. This isn’t just about capital availability—it’s about sophisticated institutional investors who understand the value of private market allocations for long-term returns. The BCG projection of super funds reaching $185 billion in private equity investments by 2025 reflects a strategic shift toward alternative assets that can deliver the consistent, inflation-protected returns that superannuation members require for their retirement security.

ESG integration has evolved from a nice-to-have consideration to a fundamental deal-making requirement that’s reshaping the entire Australian private equity ecosystem. The government’s AU$1 billion Green Iron Investment Fund exemplifies the policy support driving sustainable investment opportunities, while institutional investors representing AU$4.2 trillion in assets are demanding transparency and accountability in every investment decision. This isn’t merely about compliance—ESG performance is directly linked to long-term financial returns and risk mitigation in ways that smart capital recognizes and rewards. Australian PE firms that successfully integrate environmental and social considerations into their value creation strategies are finding themselves better positioned to attract capital, achieve premium valuations, and deliver sustainable returns that align with the evolving expectations of sophisticated institutional investors.

The infrastructure and technology sectors are becoming the cornerstone of Australia’s private equity growth story, driven by both domestic needs and global trends. Strategic transactions like I Squared Capital’s USD 300 million infrastructure partnership with Rest Superannuation demonstrate how major institutional capital is flowing toward digital infrastructure, transportation, and renewable energy projects that offer long-term, stable returns. The merger of ISPT with IFM Investors creates a global powerhouse capable of executing complex infrastructure deals while leveraging Australia’s reputation for high-quality, well-regulated assets. This infrastructure focus isn’t just about domestic opportunities—it’s positioning Australian private equity firms as preferred partners for global infrastructure capital seeking exposure to the Asia-Pacific region’s growth trajectory.

Australia Private Equity Market Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Recent News and Developments in Australia Private Equity Market

- February 2025: The Australian Government launched the AU$1 billion Green Iron Investment Fund to accelerate green manufacturing supply chains, creating significant opportunities for private equity firms specializing in sustainable industrial investments and early-stage clean technology projects with long-term growth potential.

- March 2025: I Squared Capital secured USD 300 million commitment from Rest Superannuation Fund for infrastructure investments focusing on digital infrastructure, transportation, and renewable energy, demonstrating the growing appetite among Australian super funds for alternative asset exposure through private market strategies.

- June 2025: Industry consolidation accelerated with ISPT’s strategic merger with IFM Investors creating a global private markets powerhouse, while Australian PE firms reported record levels of dry powder deployment in mid-market opportunities across healthcare, technology, and renewable energy sectors valued at over AUD 15 billion.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=31707&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302