Aircraft Insurance Market Outlook

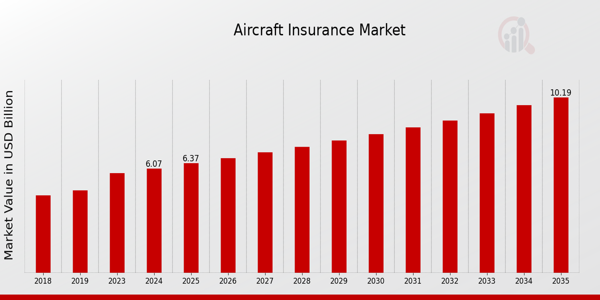

The aviation industry continues to experience significant growth, innovation, and transformation. As a crucial component of this global sector, the aircraft insurance market is also rising steadily in value and importance. According to recent market research, the aircraft insurance market was estimated at USD 5.79 billion in 2023 and is projected to grow to USD 10.2 billion by 2035, at a compound annual growth rate (CAGR) of 4.82% between 2025 and 2035.

This growth reflects the increasing complexity of the aviation landscape, rising global air traffic, evolving regulatory requirements, and the expanding fleet size across commercial, private, and military aviation sectors.

What is Aircraft Insurance?

Aircraft insurance market provides coverage for the operation of aircraft and the risks associated with aviation. These insurance policies typically cover damages to the aircraft itself, liability for passenger injuries, environmental and third-party damage, as well as cargo losses. It plays a vital role in risk management for all aviation stakeholders, including airlines, private operators, lessors, airports, and manufacturers.

Market Drivers Fueling Growth

1. Rising Global Air Traffic and Fleet Expansion

As global economies rebound and air travel demand increases post-pandemic, airlines are expanding their fleets to meet growing passenger and cargo transport needs. The influx of new aircraft—commercial jets, cargo planes, business jets, and helicopters—necessitates corresponding insurance coverage, thereby boosting the demand for aircraft insurance.

2. Increased Aircraft Leasing Activity

Aircraft leasing companies play a significant role in the aviation industry, particularly in Asia-Pacific and the Middle East. These companies require robust insurance coverage for their leased fleets to mitigate risks associated with damage, theft, or accidents. This trend is expected to further elevate the market’s growth potential.

3. Stringent Regulatory Framework

Aviation authorities and governments across the world enforce strict safety and insurance regulations. For instance, the International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA) require mandatory third-party liability insurance, pushing airline operators to maintain sufficient coverage levels. These regulatory frameworks are critical to maintaining safety and operational integrity in aviation, consequently fueling market growth.

4. Rising Risk of Cyberattacks and Terrorism

With digital transformation in aviation comes increased vulnerability to cyber threats. Moreover, geopolitical tensions and terrorism risks have necessitated more comprehensive insurance policies, including war risk and cyber liability insurance, further expanding the scope and value of the aircraft insurance market.

Market Segmentation

The aircraft insurance market is segmented based on the type of insurance, aircraft type, end-user, and region.

▪ By Type:

-

Public Liability Insurance

-

Passenger Liability Insurance

-

Combined Single Limit (CSL)

-

Ground Risk Hull (not in motion / in motion)

-

In-flight Insurance

▪ By Aircraft Type:

-

Commercial Aircraft

-

Military Aircraft

-

Helicopters

-

Private Jets

-

UAVs (Drones)

▪ By End User:

-

Commercial Airlines

-

Private Operators

-

Government & Defense Organizations

-

Leasing Companies

Among these, commercial airlines and leasing companies are the dominant end-users due to the sheer scale of fleet operations and asset values involved.

Regional Outlook

North America

North America holds a significant share in the global aircraft insurance market, driven by its mature aviation sector, extensive commercial and defense aircraft fleets, and the presence of major insurance providers and underwriters.

Europe

Europe follows closely with its strong aerospace manufacturing base, prominent commercial airlines, and robust regulatory landscape. Countries like the UK, France, and Germany are leading contributors.

Asia-Pacific

The fastest-growing region, thanks to expanding air travel, fleet modernization, and increased investment in aviation infrastructure. China and India are especially witnessing rapid growth in both commercial and defense aviation, making them lucrative markets for insurance providers.

Middle East & Africa

These regions are emerging markets, showing promise due to increased airline activities, large-scale airport development projects, and the rise of regional carriers like Emirates and Qatar Airways.

Key Players in the Market

The aircraft insurance industry includes several global and regional players who provide specialized aviation insurance products. Major players include:

-

Allianz Global Corporate & Specialty

-

AIG (American International Group)

-

Global Aerospace

-

AXA XL

-

Willis Towers Watson

-

Marsh Inc.

-

Starr Aviation

-

Aon plc

These companies are increasingly leveraging advanced technologies such as AI for risk assessment, blockchain for policy management, and data analytics to offer competitive and customized insurance solutions.

Get a Quote – Request a price quote for the report or specific research services.

Trends Shaping the Future

-

Digitalization of Insurance Services

Insurtech is transforming the traditional insurance industry. Expect aircraft insurance to benefit from digitized claims processes, AI-based risk analysis, and automated underwriting. -

Rise of Drone and Urban Air Mobility (UAM) Insurance

As drones and eVTOLs (electric vertical take-off and landing aircraft) become mainstream, specialized insurance products will emerge to cover unique risks associated with unmanned and urban air operations. -

Sustainability Considerations

With growing environmental concerns, insurers may introduce new policies or discounts for operators adopting sustainable aviation fuels (SAFs) or low-emission aircraft

Conclusion

The aircraft insurance market is poised for robust growth in the coming decade. From commercial jets to private charters and emerging drone fleets, the increasing complexity of air operations demands comprehensive and innovative insurance solutions. As the market climbs from USD 6.07 billion in 2024 to USD 10.2 billion by 2035, stakeholders who adapt to emerging technologies and evolving risks will be best positioned to lead this dynamic and high-stakes sector.