Global AAV Contract Development and Manufacturing Organizations Industry: Key Statistics and Insights in 2024-2032

Summary:

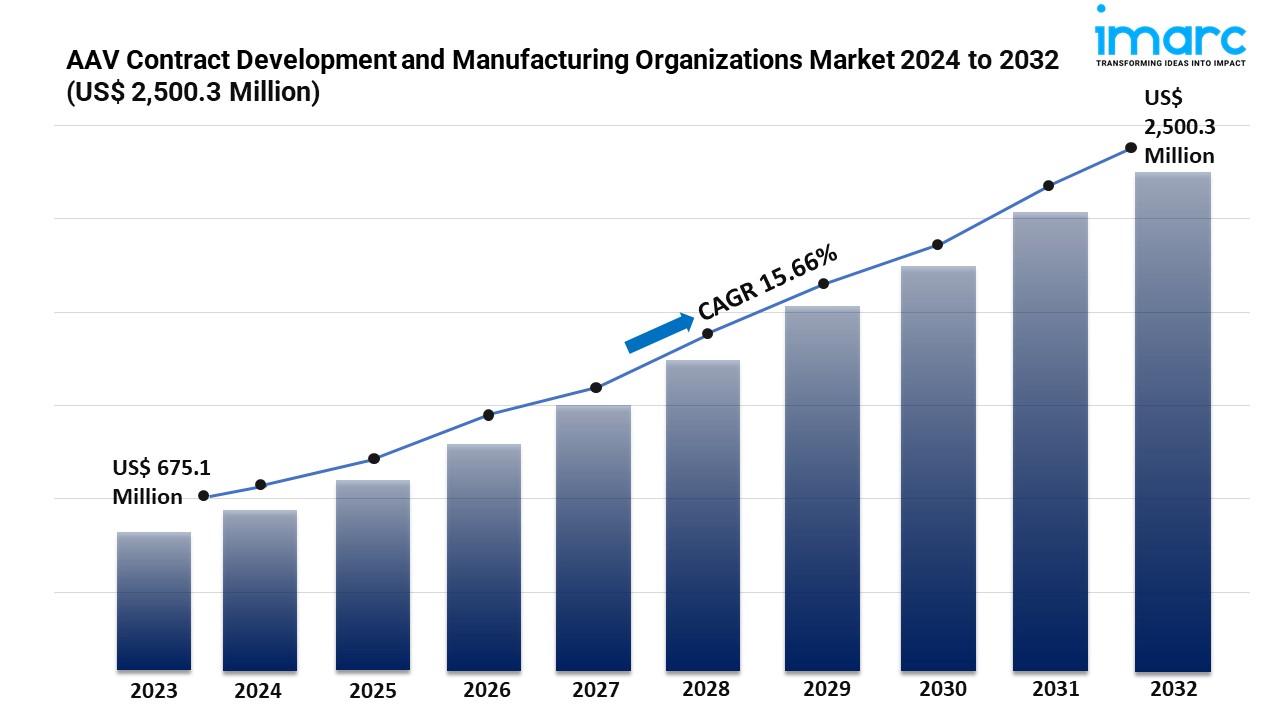

- The global AAV contract development and manufacturing organizations market size reached USD 675.1 Million in 2023.

- The market is expected to reach USD 2,500.3 Million by 2032, exhibiting a growth rate (CAGR) of XX% during 2024-2032.

- North America leads the market, accounting for the largest AAV contract development and manufacturing organizations market share.

- Downstream processing accounts for the majority of the market share in the workflow segment due to the high cost and technical expertise required for effective downstream processing.

- Adherent culture holds the largest share in the AAV contract development and manufacturing organizations industry.

- Cell and gene therapy development remain a dominant segment in the market owing to substantial investments and advancements in gene therapy research and development (R&D) activities.

- Pharmaceutical and biopharmaceutical companies represent the leading end user segment.

- The rising demand for gene therapy is a primary driver of the AAV contract development and manufacturing organizations market.

- Technological advancements and increasing research and development (R&D) investments are reshaping the AAV contract development and manufacturing organizations market.

Industry Trends and Drivers:

- Growing demand for gene therapy:

Gene therapies, which aim to treat or cure genetic disorders by modifying or replacing defective genes, are becoming more prevalent. AAV vectors are commonly used in these therapies due to their safety profile and ability to deliver therapeutic genes effectively. As more gene therapies are developed and approved, the demand for AAV manufacturing services increases. The development of gene therapies requires large quantities of AAV vectors. As gene therapies progress from clinical trials to commercial production, the need for scaling up AAV production becomes crucial. CDMOs with expertise in AAV production are essential to meet these large-scale manufacturing requirements.

- Increased R&D investment:

Increased R&D investment in gene therapy leads to a higher number of research projects focusing on developing new therapies and applications. AAV vectors are a critical component in these projects due to their efficacy and safety. This heightened research activity boosts the demand for specialized AAV manufacturing services from CDMOs. Substantial R&D funding often translates to more gene therapy candidates moving into early-stage clinical trials. For these trials, large quantities of AAV vectors are needed to test the therapies in human subjects. CDMOs play a crucial role in providing these vectors, leading to increased business for companies specializing in AAV manufacturing.

- Technological advancements:

Innovations in genetic engineering and vector design technologies allow for the creation of more effective and targeted AAV vectors. Improvements in vector design can lead to enhanced gene delivery, reduced immune response, and better therapeutic outcomes. CDMOs that stay at the forefront of these technological innovations are better positioned to offer cutting-edge solutions, attracting more clients. Technological progress in production techniques, such as more efficient cell lines, improved fermentation processes, and high-yield production methods, enhances the efficiency and scalability of AAV manufacturing. CDMOs adopting these advancements can produce AAV vectors more cost-effectively and at larger scales, meeting the growing demands of the market.

Explore full report with table of contents: https://www.imarcgroup.com/aav-contract-development-manufacturing-organizations-market/requestsample

AAV Contract Development and Manufacturing Organizations Market Report Segmentation:

Breakup By Workflow:

- Upstream Processing

- Downstream Processing

Downstream processing represents the largest segment due to the complexity and importance of ensuring high-quality and contamination-free products.

Breakup By Culture Type:

- Adherent Culture

- Suspension Culture

Adherent culture accounts for the majority of the market share owing to their established processes for high-density cell growth and efficient vector production, leading to their majority market share.

Breakup By Application:

- Cell and Gene Therapy Development

- Vaccine Development

- Biopharmaceutical and Pharmaceutical Discovery

- Biomedical Research

Cell and gene therapy development exhibits a clear dominance in the market because of their central role in innovative treatments for genetic disorders, resulting in their dominance in the market.

Breakup By End User:

- Pharmaceutical and Biopharmaceutical Companies

- Academic and Research Institutes

Pharmaceutical and biopharmaceutical companies hold the biggest market share, driven by their extensive investment in gene therapies and need for large-scale, reliable vector production.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the AAV contract development and manufacturing organizations market on account of its advanced biotechnology infrastructure, significant R&D investments, and high demand for innovative gene therapies.

Top AAV Contract Development and Manufacturing Organizations Market Leaders: The AAV contract development and manufacturing organizations market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- ABL Manufacturing (Institut Mérieux)

- Asklepios BioPharmaceutical Inc. (Bayer AG)

- Anlongbio

- Belief Biome Inc.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Creative Biogene

- GenScript ProBio (GenScript Biotech Corporation)

- Merck KGaA

- Oxford Biomedica

- TFBS Bioscience Inc.

- Thermo Fischer Scientific Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163