Running a small business means wearing a lot of hats—owner, marketer, manager, and sometimes even bookkeeper. But let’s be honest: managing your books isn’t why you started your business. That’s where outsourced bookkeeping for small business comes into play.

If you’re wondering whether outsourcing your bookkeeping is worth it, how it works, or where to find the right service, you’re in the right place. In this guide, we’ll break it all down in plain English.

What Is Outsourced Bookkeeping?

Outsourced bookkeeping means hiring an external professional or firm to manage your day-to-day financial records instead of doing it in-house.

This includes:

- Recording transactions

- Managing accounts payable/receivable

- Reconciling bank statements

- Preparing financial reports

- Supporting tax preparation

Instead of juggling spreadsheets and invoices, you hand it over to experts—saving you time, reducing errors, and giving you peace of mind.

💡 Why Should Small Businesses Outsource Bookkeeping?

Great question! Here’s why many small business owners are making the switch:

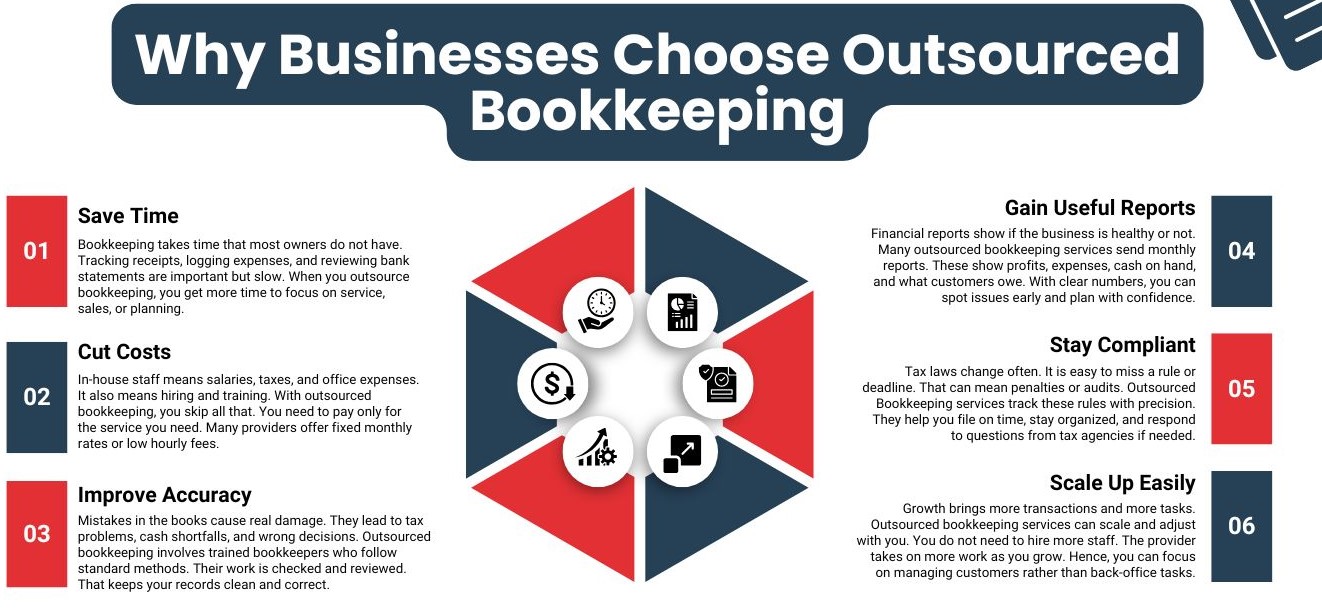

1 Save Time

Think about how many hours a month you spend on bookkeeping tasks. Now imagine putting that time back into growing your business. That’s the real power of outsourcing.

2 Cost-Effective

Hiring a full-time bookkeeper can be expensive. With outsourcing, you only pay for the services you need—no employee benefits, no office space, no training costs.

3 Access to Experts

Outsourced firms stay updated on financial regulations, software, and tax rules. You get expert-level help without hiring in-house.

4 Scalability

Whether you’re a solo entrepreneur or scaling up fast, outsourced bookkeeping grows with you. No need to change systems every time you expand.

How Does Outsourced Bookkeeping Work?

Most modern bookkeeping services work remotely and securely using cloud-based accounting tools like QuickBooks Online, Xero, or Zoho Books.

Here’s what a typical process looks like:

- Initial Setup & Software Integration

- Ongoing Transaction Management

- Monthly Reconciliation & Reporting

- On-Demand Support for Tax Season or Audits

Your provider may offer custom dashboards so you can monitor your finances in real time—wherever you are.

Who Should Consider Outsourced Bookkeeping?

Outsourced bookkeeping isn’t just for big corporations. It’s perfect for:

-

Freelancers and consultants

-

E-commerce businesses

-

Startups and fast-growing teams

-

Service-based companies

-

Local businesses with limited staff

If you find yourself spending evenings on accounting or worrying about tax season, it’s time to get support.

Key Advantages of Outsourcing Bookkeeping for Small Business Owners

Managing financial records is essential, but it doesn’t have to consume your energy or slow down your business operations. Many entrepreneurs today are moving away from manual accounting tasks and choosing to partner with outsourced bookkeeping professionals. Why? Because it brings efficiency, accuracy, and peace of mind.

Outsourced bookkeeping services allow small businesses to focus on customer service, sales, and growth—while leaving the financial record-keeping to trained professionals. These services are ideal for small teams without a dedicated finance department or those who want to avoid the overhead of in-house hires.

🔧 Services Typically Included in Outsourced Bookkeeping

Depending on the service provider you choose, outsourced bookkeeping can include a variety of tasks, such as:

-

Monthly financial statement preparation

-

Daily expense tracking and reporting

-

Tax-ready documentation

-

Payroll management

-

Budgeting and forecasting

-

Accounts payable and receivable management

Some firms also provide controller-level insights or collaborate directly with your accountant or CPA during tax season. This ensures all data remains organized and audit-ready throughout the year.

Why Is Outsourced Bookkeeping Growing in Demand?

The rise of digital tools and cloud accounting platforms has made remote bookkeeping not only possible but highly efficient. Software like Xero, FreshBooks, Sage, and Wave offer real-time access to financial data—giving business owners full visibility without needing to handle the numbers themselves.

In fact, many bookkeeping service providers now offer real-time dashboards, cash flow reports, and integrations with tools like Shopify, Stripe, or Tally—making it easier than ever to keep tabs on your business’s financial health.

Choosing the Right Provider Based on Your Business Needs

When selecting a bookkeeping partner, consider their experience with businesses similar to yours. A local restaurant will have very different needs from an online retailer or service-based agency.

Also, if you’re based in a specific location (like Mumbai, New York, or London), working with a provider familiar with regional tax laws and financial regulations will make compliance easier. Look for firms that offer industry-specific expertise and provide transparent pricing, accessible support, and clear communication.

A Strategic Step Toward Growth

As a small business owner, you don’t have to do everything yourself. Outsourcing your bookkeeping is more than just a time-saver—it’s a strategic decision that can support better planning, reduce stress, and improve the financial stability of your business in the long term.

Ready to Outsource Your Bookkeeping?

If you’re spending too much time on spreadsheets, worried about financial accuracy, or just ready to get your evenings back—outsourcing might be your next smart move.

It’s not just about saving money. It’s about getting clarity, peace of mind, and more time to do what you do best: running your business.