Running a business in Florida comes with various responsibilities, and one of the most important tasks is calculating the correct sales tax for your products and services. Whether you own a small store, provide freelance services, or manage an online shop, using a Florida sales tax calculator ensures you charge your customers accurately and comply with state regulations. This not only builds trust with your customers but also protects your business from penalties related to tax errors.

Florida has a state sales tax rate of 6%, but depending on the location of your business or customer, additional local surtaxes may apply. These county surtaxes range from 0.5% to 2.5%. This means if you’re selling goods or services in Miami-Dade, Orange County, or any other Florida county, you need to be aware of the local tax rates to calculate the correct total sales tax. A manual calculation might seem simple at first glance, but it becomes tricky when you deal with multiple locations or varying surtax rates. This is where a sales tax calculator Florida tool becomes a reliable companion for business owners.

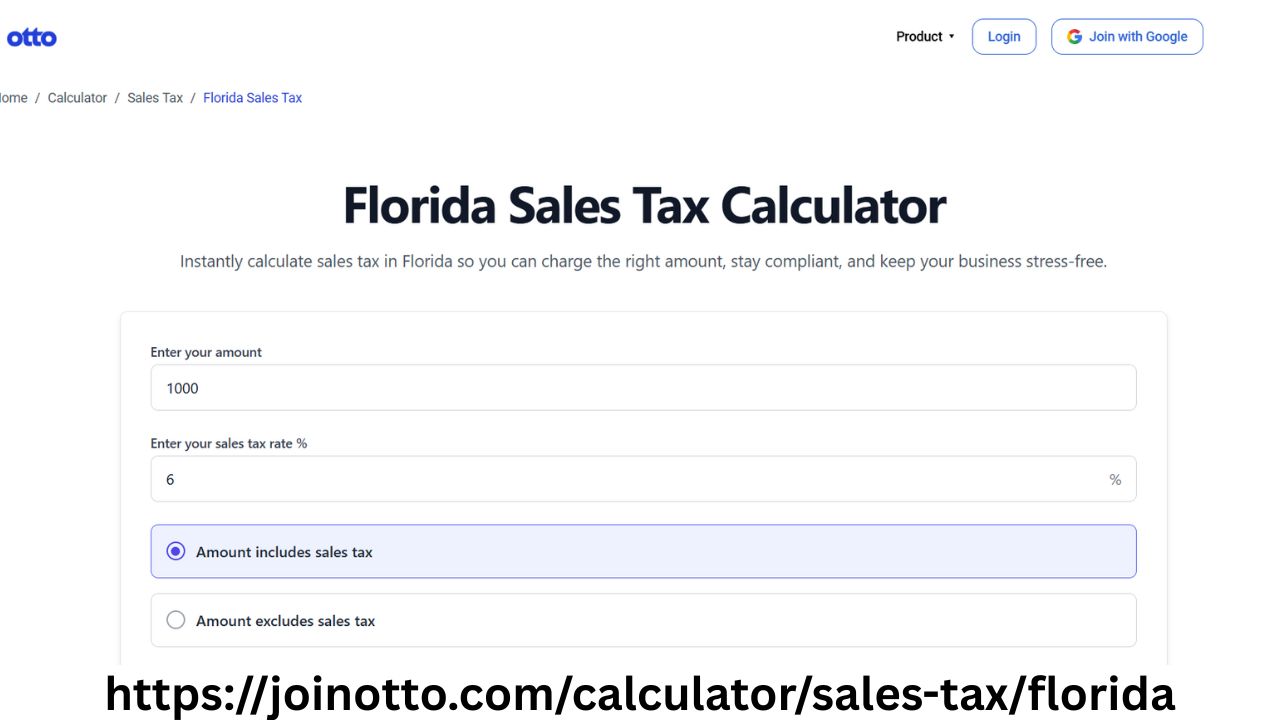

The Florida tax calculator sales tool offered by Otto AI is designed to take the stress out of tax calculations. Instead of spending time manually researching county surtaxes or making complex spreadsheets, business owners can simply input the sales amount, select the location, and instantly get an accurate sales tax amount. This helps avoid undercharging or overcharging customers, which can affect your business reputation and cash flow.

For entrepreneurs who offer services that are taxable in Florida, having a sales tax in Florida calculator is especially useful. Service providers often struggle with knowing which services are taxable and which aren’t. Florida tax laws can be complex, but a dedicated calculator tool simplifies this by focusing only on the taxable amount you enter, reducing the chance of miscalculations.

Online sellers and e-commerce businesses also face challenges when customers from different counties place orders. Using a sales tax Florida calculator allows you to apply the correct county surtax automatically. This ensures your invoices are accurate and helps in bookkeeping, making tax filing smoother at the end of each quarter or year. Without such a tool, businesses risk human error, which can lead to overpaying taxes or facing audits due to discrepancies.

The Otto AI Florida sales tax calculator is also extremely beneficial for self-employed individuals who juggle multiple responsibilities. Freelancers, gig workers, and independent contractors often lack the resources of larger businesses, so having an easy-to-use tax calculator saves valuable time. It also allows self-employed professionals to focus on their core work without the added burden of tax complexities.

One of the overlooked benefits of using a sales tax calculator Florida tool is how it aids in pricing strategies. When business owners know the exact tax amount that will be added to a product or service, they can make better decisions regarding pricing to maintain profitability while keeping prices competitive. It’s a small step, but it can have a big impact on business success.

For businesses dealing with bulk orders or large invoices, the Florida tax calculator sales tool ensures there are no surprises. By calculating the correct tax on large transactions, businesses can provide transparent billing to their clients. This not only builds trust but also helps in maintaining clear records, which are essential during tax season.

The importance of a sales tax in Florida calculator becomes even more evident when businesses expand their operations to different counties within the state. With surtax rates varying across counties, a calculator tool that factors in these rates can be a lifesaver. It reduces administrative headaches and allows businesses to stay focused on growth.

In addition to accuracy, using a Florida sales tax calculator saves time. Manual tax calculations for every sale can be tedious, especially for busy entrepreneurs who already manage marketing, customer service, inventory, and other aspects of their business. Automating tax calculations with a reliable tool streamlines the billing process and minimizes errors.

For businesses that deal with discounts, promotions, or tax-exempt sales, a sales tax calculator Florida tool is essential. It helps correctly apply taxes after discounts or identify situations where tax is not applicable. This is particularly important for businesses offering products to tax-exempt organizations or government agencies.

Otto AI’s Florida tax calculator sales tool is designed keeping in mind the real-life challenges of small businesses and self-employed individuals. Its user-friendly interface ensures that even those with minimal technical knowledge can use it effectively. There’s no need to install complicated software; the tool is accessible online, making it convenient for businesses operating from anywhere.

Proper tax calculation is not just about compliance; it also reflects a business’s professionalism. Providing accurate invoices builds trust with customers and enhances the business’s reputation. A sales tax in Florida calculator helps maintain this accuracy consistently, no matter how large or small the transaction.

For seasonal businesses or those that experience fluctuations in sales volume, having a flexible tool like the Florida sales tax calculator ensures you’re always ready to handle changes. Whether it’s peak season or off-season, you can quickly adjust your calculations to suit the current sales volume.

Many businesses often overlook how small miscalculations in sales tax can add up over time, leading to significant financial discrepancies. A reliable sales tax Florida calculator minimizes this risk by ensuring precision in every transaction. This is particularly useful for businesses dealing with recurring invoices, subscription models, or installment payments.

As your business grows, managing taxes manually becomes impractical. With a Florida tax calculator sales tool, scaling your operations becomes smoother because the tool can handle increased transactions without losing accuracy. It also makes training new staff easier since they can rely on the calculator rather than memorizing tax rates and formulas.

The convenience of having a sales tax in Florida calculator at your fingertips empowers business owners to focus on what truly matters — growing their business. Instead of getting bogged down by tax paperwork, you can invest your time in strategy, customer engagement, and product development.

In conclusion, using a Florida sales tax calculator is no longer a luxury but a necessity for businesses aiming for accuracy and efficiency. Otto AI offers a dependable tool that takes the guesswork out of tax calculations, making it easier for small businesses, self-employed individuals, and entrepreneurs to stay compliant and professional. By simplifying this essential process, you can save time, avoid errors, and focus on driving your business forward.