Managing payroll for your business can often feel like a daunting task, especially if you’re trying to handle everything manually. However with the advent of digital tools, payroll processing has become easier and more efficient. One of the most helpful tools you can use is a free paycheck creator. This simple yet powerful tool can save you time, reduce errors, and make payroll a much smoother process.

In this blog, we’ll walk you through what a paycheck creator is, how it works, and why it’s a game-changer for businesses of all sizes. We’ll also explore some of the key benefits of using a free paycheck creator, and how it can boost your payroll efficiency.

Table of Contents

ToggleWhat is a Free Paycheck Creator?

A paycheck creator is an online tool or software that helps you generate accurate paychecks for your employees. It calculates their earnings, tax deductions, and other important details automatically, based on the information you provide. The best part? There are free versions of paycheck creators available, making it accessible to businesses, especially small businesses or startups, that want to streamline payroll without breaking the bank.

Many paycheck creators allow you to enter basic details such as:

- Employee Information: Name, address, job title, etc.

- Pay Period: Weekly, bi-weekly, monthly, etc.

- Hours Worked: Total hours worked by the employee during the pay period.

- Hourly Rate: If the employee is paid hourly.

- Salary Information: For salaried employees, the tool will calculate the fixed earnings.

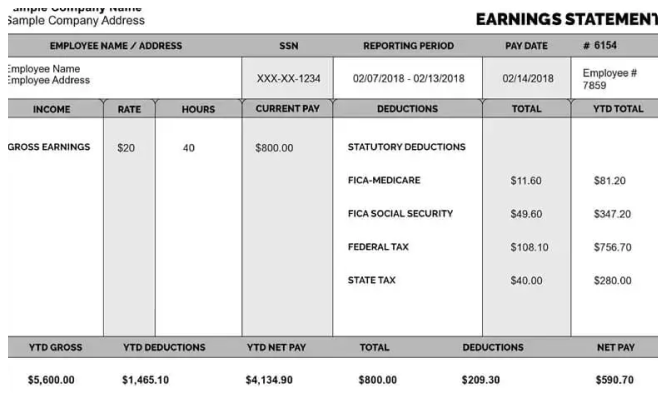

Once you’ve entered the necessary details, the paycheck creator will calculate the employee’s gross pay, tax withholdings, deductions for benefits, and any other relevant factors. Then, it generates a pay stub that shows a breakdown of the employee’s earnings and deductions.

Why Should You Use a Free Paycheck Creator?

There are plenty of reasons to incorporate a free paycheck creator into your payroll process. Let’s take a look at some of the top advantages:

1. Cost Savings

For small business owners, every penny counts. Payroll software can sometimes be expensive, especially if you don’t need all the advanced features. A free paycheck creator gives you the tools you need without the cost, allowing you to put those savings towards other parts of your business.

2. Time Efficiency

Manual payroll calculations are time-consuming and prone to errors. With a paycheck creator, all you need to do is input the right information, and the software will automatically calculate everything for you. This means you spend less time on payroll and more time on other important tasks, such as growing your business.

3. Error Reduction

Human error is one of the most common causes of payroll mistakes. Simple miscalculations or missed deductions can lead to issues with employee satisfaction and legal problems. A free paycheck creator helps eliminate these errors by providing accurate calculations and instantly generating a pay stub with all the correct information. This gives you peace of mind knowing your payroll is accurate.

4. Ease of Use

You don’t need to be a payroll expert to use a free paycheck creator. These tools are designed to be user-friendly, with easy-to-follow prompts that guide you through the entire process. This makes them ideal for small business owners or managers who may not have a background in accounting or finance but still need to manage payroll effectively.

5. Customizable Features

Many paycheck creators allow you to customize various aspects of the pay stub. You can add or remove specific deductions, include employee bonuses, and adjust tax settings based on your state’s laws. This level of flexibility ensures that your payroll is always up to date and in compliance with local regulations.

6. Employee Transparency

Paycheck creators often provide employees with a detailed breakdown of their earnings, taxes, and other deductions. This transparency helps employees understand exactly how their pay is calculated, leading to greater trust between employer and employee. Providing employees with easy access to their pay stubs through digital tools also helps them keep their records organized.

7. Tax Compliance

Tax regulations can be complicated and vary from state to state. A free paycheck creator ensures that all necessary tax deductions are made automatically, so you don’t have to worry about missing anything important. This reduces the risk of tax-related issues down the line and helps keep your business compliant with federal, state, and local tax laws.

How Does a Free Paycheck Creator Work?

While the specific features of paycheck creators may vary from one tool to another, the basic process is fairly similar across platforms. Here’s how a typical paycheck creator works:

Step 1: Choose the Pay Period

Most paycheck creators will prompt you to choose a pay period (weekly, bi-weekly, monthly, etc.). You’ll need to select this based on your payroll schedule.

Step 2: Input Employee Information

The next step is to enter your employee’s details, such as name, address, and employee ID (if applicable). You will also need to provide information about the type of pay the employee receives (hourly or salaried), along with their hourly rate or salary amount.

Step 3: Enter Hours Worked (for Hourly Employees)

If your employee is paid hourly, you’ll need to input the total number of hours worked during the pay period. The paycheck creator will then multiply their hours by their hourly rate to calculate their gross earnings.

Step 4: Apply Deductions and Taxes

Most paycheck creators will ask for information on deductions such as federal income tax, state tax, Social Security, Medicare, and other benefits (health insurance, retirement contributions, etc.). You’ll need to input these values for accurate calculations. The tool will automatically apply these deductions and provide the final net pay.

Step 5: Generate the Pay Stub

After entering all the required information, the paycheck creator will generate a pay stub. This pay stub will show the employee’s gross pay, deductions, and net pay (the amount they will actually receive). It will also include a breakdown of taxes and any other relevant deductions.

Step 6: Distribute Pay Stubs to Employees

Once the pay stubs are generated, you can distribute them to your employees electronically or print them out. Many paycheck creators allow employees to download and access their pay stubs online, making it easy for them to keep their records.

Popular Free Paycheck Creators

There are many free paycheck creators available online, each with its unique features and benefits. Here are a few popular ones:

1. Wave Payroll

Wave Payroll offers a free paycheck creator that is ideal for small businesses. You can generate paychecks, manage payroll taxes, and even integrate it with your Wave accounting software.

2. Paycheck Calculator by ADP

ADP’s paycheck calculator is a simple and free tool that can help small business owners quickly calculate wages, taxes, and deductions. While it doesn’t provide full payroll services, it’s a great starting point for generating pay stubs.

3. QuickBooks Paycheck Calculator

QuickBooks offers a free paycheck calculator tool that’s easy to use. You can generate accurate pay stubs for your employees, and the tool automatically calculates taxes and deductions.

4. Zenefits Paycheck Generator

Zenefits offers a free paycheck generator as part of its HR software. This tool lets you calculate employee pay based on salary, hourly wages, overtime, and other factors. It’s a great option for businesses looking to streamline both payroll and HR functions.

Conclusion

A free paycheck creator is a valuable tool for any business, particularly for small business owners who want to streamline payroll without spending money on expensive software. With its time-saving features, error reduction, and customizable options, a paycheck creator can boost payroll efficiency and help keep your business compliant with tax laws.

By using a free paycheck creator, you can save money, reduce mistakes, and provide your employees with transparent and accurate pay stubs every time. Whether you’re managing a handful of employees or a larger team, a paycheck creator can simplify payroll and help your business run more smoothly. So, give it a try and experience the benefits of an efficient, hassle-free payroll process today.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?